Very few retail organizations are structured to handle the business disruption or cost of being the early adopters of new technology. This is especially true when the technology has a direct impact on the communications with all of their largest suppliers. However, over the past twenty-four months, we have begun to see the adoption of demand driven supply chain strategies beyond the early adopters, and into a much larger and more wide-spread early majority. This is causing many retail executives to take notice and begin to seriously plan out their organization’s approach. This leads to two key questions we consistently hear from these executives; first, what are the world-class leaders doing, and second, how can we quickly and cost effectively realize the process improvement without a huge technology investment?

One of the key lessons learned from watching the early adopters implement the demand driven supply chain is, that technology is only a small part of success. The technology is simply a foundation which allows buyers and suppliers to establish collaborative joint business processes. In fact, if approached as merely a technology project, one might as well just use EDI or Excel and call it a day.

However, world-class leaders are sharing with suppliers a rich data set, including SKU level data, and they are providing the information analysis tools to make the data immediately actionable. Sharing a rich data set provides a supplier and buyer the framework for a valuable and detailed conversation around sales and inventory. End users can begin their evaluation at a category or product family level, and then drill down the hierarchy all the way to an individual SKU.

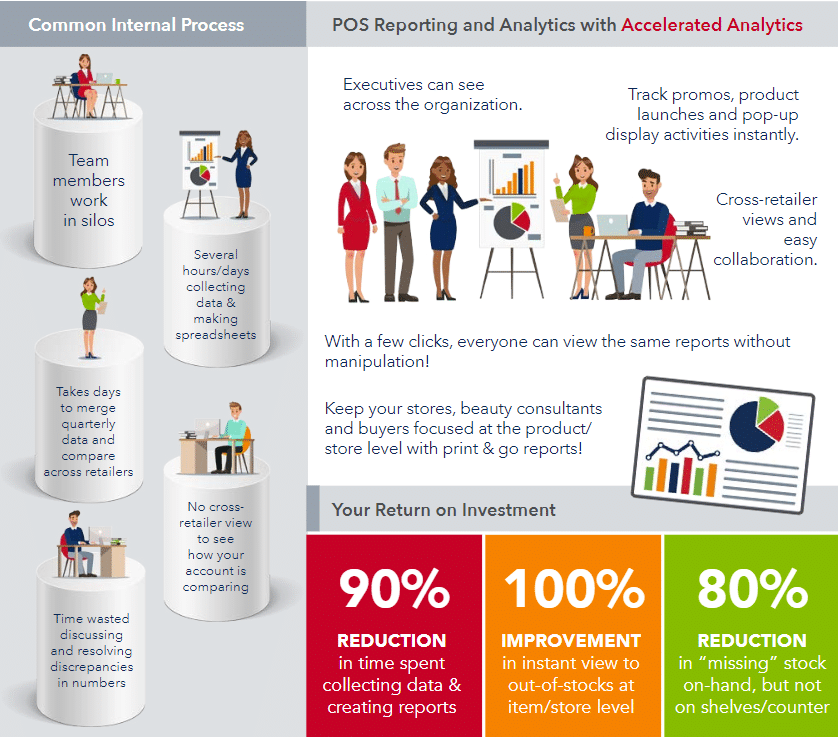

Rather than a data dump using EDI, Excel or downloadable files in a vendor portal, world class leaders have implemented information sharing tools. Information sharing tools transform rows and columns of data into visual performance dashboards and provide exception condition monitoring, so an end user can quickly interpret the information and take necessary actions. They bridge the gap between bytes of data and the information necessary for managing in-stock levels. With the addition of an exception dashboard, the end user can be quickly alerted to problems and opportunities without having to scrutinize each SKU individually in some massive spreadsheet. The dashboard also establishes one common version of the truth, so time previously spent explaining how reports were calculated, can be spent finding the next big cost savings. Our clients tell us that just having everyone on the same page can save dozens of hours each week, then multiply that times hundreds of suppliers.

The second question we often hear, involves how to most cost effectively implement a demand driven supply chain. Here, the lesson to be learned from the early adopters is the cost they paid to build the infrastructure. For example, Wal-Mart estimates a $4 billion dollar investment into Retail Link, which is a shocking number, until you consider the scope and complexity of the project for over 10,000 suppliers. For example, a mid-sized specialty or hard goods retailer with 600 stores, is likely to have about 2,000 suppliers, 400 of which are on active replenishment and will be part of a data sharing program. On average, each of the 400 suppliers will have two users (one sales and one operations), and the retailer will have approximately 50 users who need to directly collaborate with the supplier community, so there is a universe of approximately 850 users to provide with data, software, training and help desk support. The end user reporting tools sit on top of a database, which can easily grow to multiple terabytes because world-class leaders are using a very rich data set, including SKU level sales and inventory across a historical timeline of 18 months. Anytime there is a large technology infrastructure cost to support a business process for several hundred globally dispersed end users, you have a good candidate for outsourcing. And as previously stated, the value is derived from the collaborative exchange between the buyer and supplier, not from the transfer and management of bytes of data, so why not turn that variable cost into a fixed monthly purchase and let the provider manage the risk. Outsourcing also provides the additional benefit of a service level agreement, so all parties can be confident the system will be available and ready when they want to use it.

Our article titled “The Case for Supply Chain Collaboration”, and published in vol 1 of the Journal of Trading Partner Practices, identified the financial opportunities associated with the demand driven supply chain. These benefits include increasing sales by 5 to 10% and operating margin improvement of 5 to 7%. Now that the early adopters have paved the way and learned the tough lessons, we are seeing the early majority start to move. Now is the time to talk with your team and determine how best to implement a demand driven supplier collaboration program at your organization.