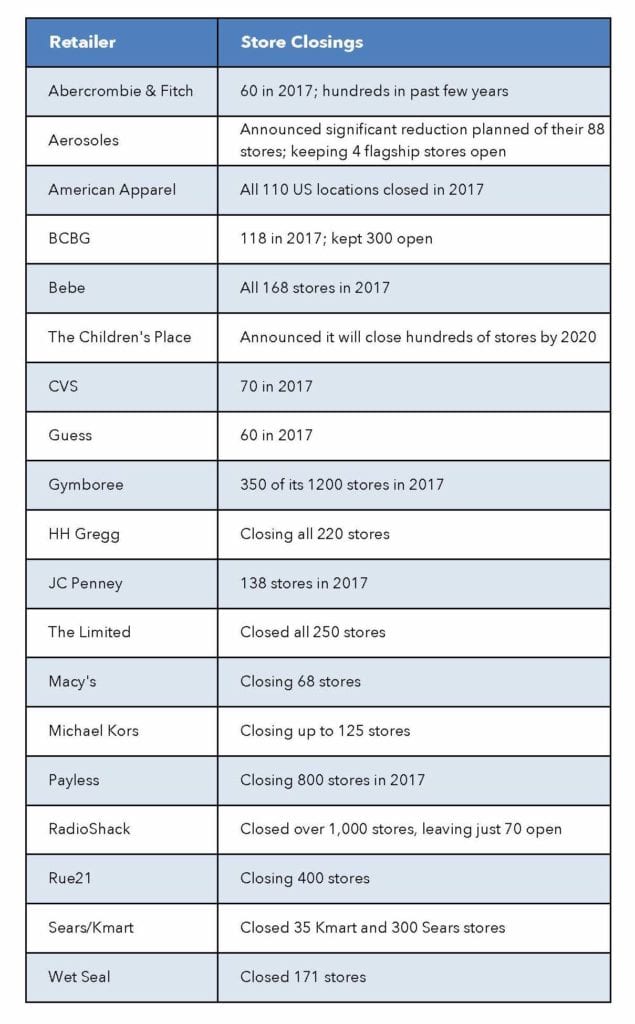

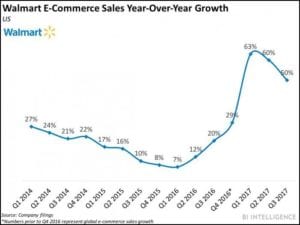

The year 2017 is being talked about as the “year of the retail apocalypse”. Over 3000 companies have filed for bankruptcy, and 20 big retailers have or are about to close hundreds of brick and mortar stores in the US. With the big holiday weekend of Thanksgiving/Black Friday and Cyber Monday behind us, consumers are proving that online shopping will continue to prevail, and retailers are making adjustments to focusing on digital platforms, while still trying to entice shoppers into their remaining stores. Being a big toy buying season, the announcement of Toys R Us’ bankruptcy filing is taking center stage, but the retailer maintains it will keep its 1,600 stores open. Amazon won the weekend with sales with 13 million transactions in just the first two days. They were followed by WalMart, Best Buy, Target and Kohl’s.

Amid the gloom, some retailers are still seeing success, and as many retailers shrink, other new retailers are making their way into brick and mortar to take their place. Perhaps rather than an “apocalypse’ retail is seeing an “evolution”.

Sources: Fox Business, Chain Store Age