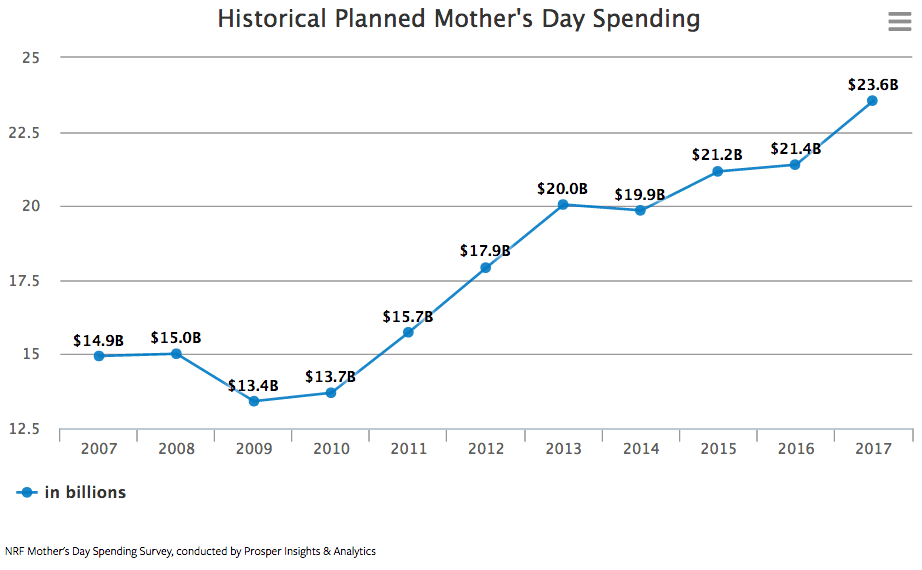

After four slow winter months, consumers rebounded in April, increasing spending .4% from the previous month. Economists are crediting income growth, low inflation, low interest rates and rising household wealth for the rise. The Federal Reserve Bank of Atlanta predicted on Tuesday that gross domestic product would expand at 3.8%. Inflation is still weakened versus last year, and overall prices rose 1.7% in April, down from 1.7% in March.

The rise in spending was led by a .9% rise in spending on durable goods, such as autos. Spending on non-durable goods included clothing up .6%. American’ average daily spending in April was $107, up $7 from March. This is the highest spending average since May 2008. Though retail sales dropped in Q1, April could be a turning point. A Gallup poll found that Americans still prefer saving to spending, but the actual amounts they are spending has been rising.

Sources: WSJ, USA Today, Gallup