I think my family set a new record yesterday. As we were pulling into the driveway last night after our daughter’s high school chorus concert, I looked at the house, admiring our holiday lights, and spied a package on our front porch. I laughed and told my husband that I think that brought the day’s total to seven – surely a record. But when I opened the front door to retrieve it, I saw that there were actually two packages on the porch, bringing the day’s grand total to eight packages delivered. And they were all from Amazon.com.

My husband and I have been members of Amazon Prime for as long as I can remember. We joined years and years ago, back before they streamed music, tv and movies and way before e-commerce and Cyber-Monday were an integral part of holiday shopping. In fact, I can’t really remember life before Amazon Prime. And if you tell me you’re not a member I’ll likely react with a stunned look of disbelief and feel kind of sorry for you. You mean you wait more than two days for your packages AND you pay for shipping?

Suffice it say we’re fans of the e-commerce giant. It’s not uncommon for me to place multiple orders in one day, because, well, I can. And as I do, I often think to myself “Gosh, the people at Amazon must hate us.” I imagine the holiday elves at the Amazon warehouses cursing our family and wondering if we’re just trying to make their lives difficult. If they had a naughty list, I feel sure we’d be on it. But . . . they make it so easy. In reality, my guess is we’re not so different from all of the other Amazon Prime members out there this holiday season and anytime for that matter.

In a blog post this fall, we reported that ecommerce in general continues to grow at a rate that outpaces retail growth. We detailed that according to eMarketer, while moderate growth of 3.3% is expected for 2016 holiday retail overall, ecommerce is expected to make its biggest jump since 2011 and post growth of 17.2% this holiday season.

With an estimated U.S. ecommerce market share reported anywhere between 40% and over 65%, Amazon.com is the biggest player in the ecommerce market. Amazon Prime was launched in 2005 for $79 a year as an unlimited express shipping membership program for about 1 million products. While Amazon doesn’t disclose the exact number of Prime members, today it’s estimated to be about 80 million worldwide and about 65 million in the US alone. According to Statista.com, that’s an increase of 10 million subscribers since December of last year and more than double the estimated 25 million subscribers in December of 2013. Clearly, Prime’s growth has ramped up over the past few years as they have added more benefits, and content, expanded to new markets and introduced new membership options. Earlier this year Amazon Prime began offering monthly Prime membership plans for $10.99 a month and a monthly Prime Video plan for $8.99 a month, giving consumers more options and attracting new subscribers.

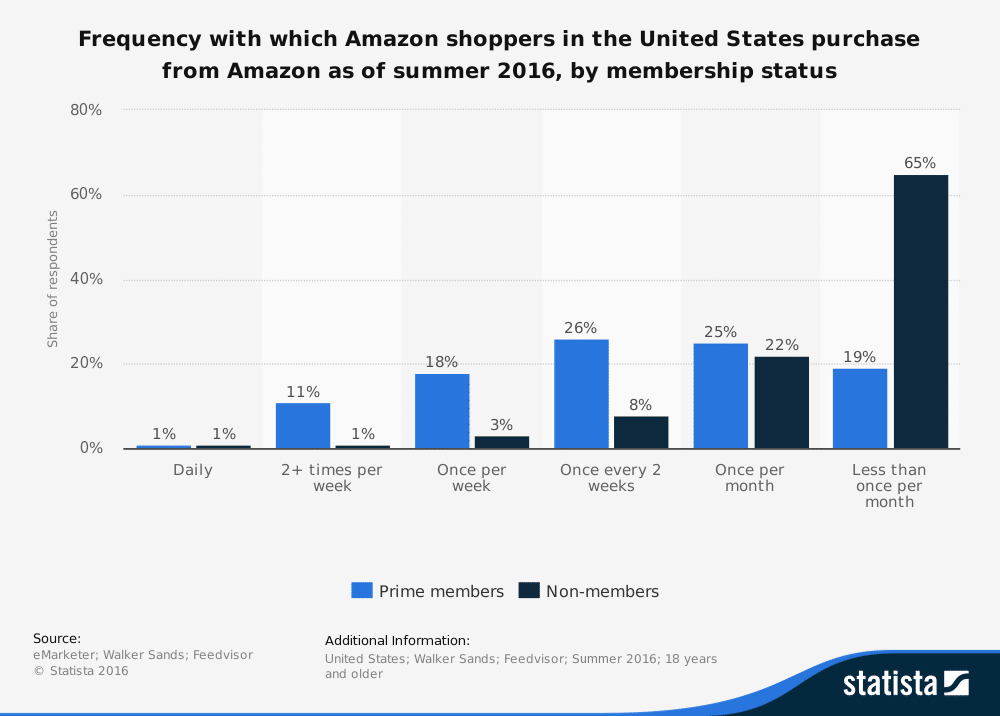

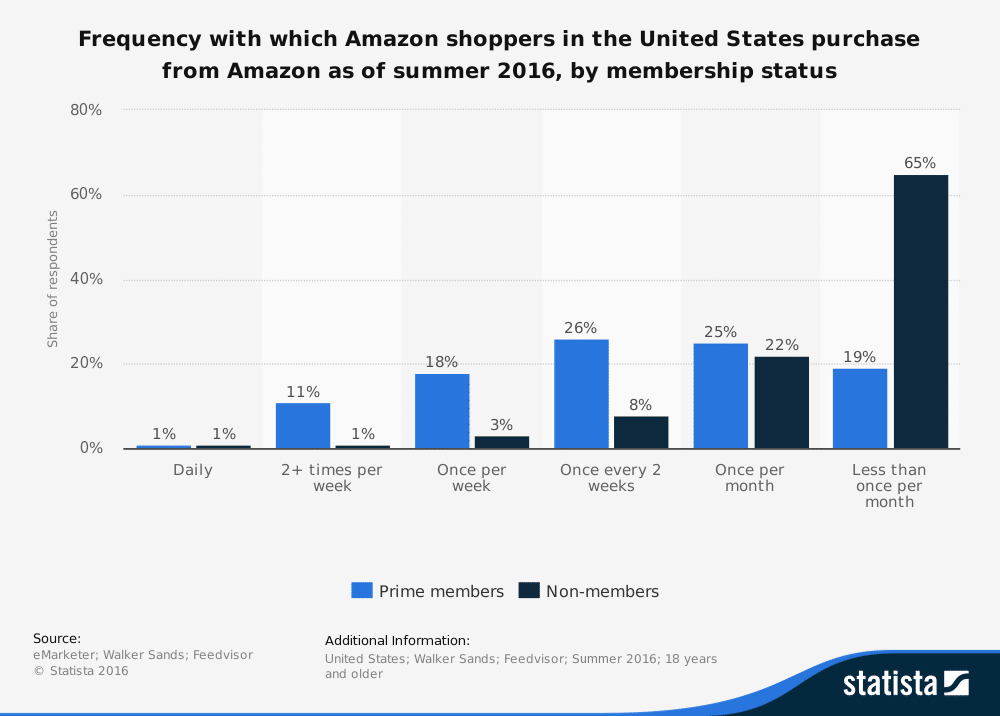

According to Consumer Intelligence Research Partners (CIRP), just over half of Amazon customers – 52% – are Prime members, each of whom spend an average of $1200 a year. That compares to approximately $600 per year spent by non-Prime members. And if you look at the frequency with which Amazon shoppers make a purchase on Amazon.com, Prime members are far more likely to shop more frequently than non-Prime members. According to a survey reported on Statista.com, 18% of responding Amazon Prime members said that they shop on the website at least once a week and 11% of responding Amazon Prime members said that they shop on the website at least twice a week.

So while my family’s delivery record seemed extreme yesterday, it sounds like our Prime-junkie tendencies place us in good company with a boatload of U.S. consumers. Hopefully we aren’t irritating the heck out of the Amazon shipping employees, and maybe they even just smile and shake their heads when we place our third or fourth order of the day. I hope so, because I just thought of another gift I need to order.

The string of beauty deals continues in the new year with significant beauty acquisitions for Accelerated Analytics customers L’Oréal and Coty, all within a 48-hour period earlier this week.

The string of beauty deals continues in the new year with significant beauty acquisitions for Accelerated Analytics customers L’Oréal and Coty, all within a 48-hour period earlier this week. Stanley will pay $525 million up front – the deal is expected to close later this year – and another $250 million at the end of year three. Stanley will also pay Sears a percentage of its new sales of Craftsman products for 15 years, and Sears will continue to sell Craftsman-branded products through a perpetual license deal, which will be royalty-free for the first 15 years, and royalty-bearing after that.

Stanley will pay $525 million up front – the deal is expected to close later this year – and another $250 million at the end of year three. Stanley will also pay Sears a percentage of its new sales of Craftsman products for 15 years, and Sears will continue to sell Craftsman-branded products through a perpetual license deal, which will be royalty-free for the first 15 years, and royalty-bearing after that.