I had the opportunity to lead this session last week and came back with some takeaways that I wanted to share, as I feel they are reflective of the state of retail today and how retailers and vendors are using point-of-sale data to manage their business in this time of OMNI-channel, customer-experience driven retail.

Customers want a single-vision of brands and be able to have a consistent, complete and winning experience every time they shop, in whatever channel they shop in. To ensure products are available when and where the customer shops, retailers need real-time inventory visibility, a seamless order management system and the ability to deliver. Retailers and brands realize they need to work together to have both a single view of the customer and a single view of their data in order to be successful.

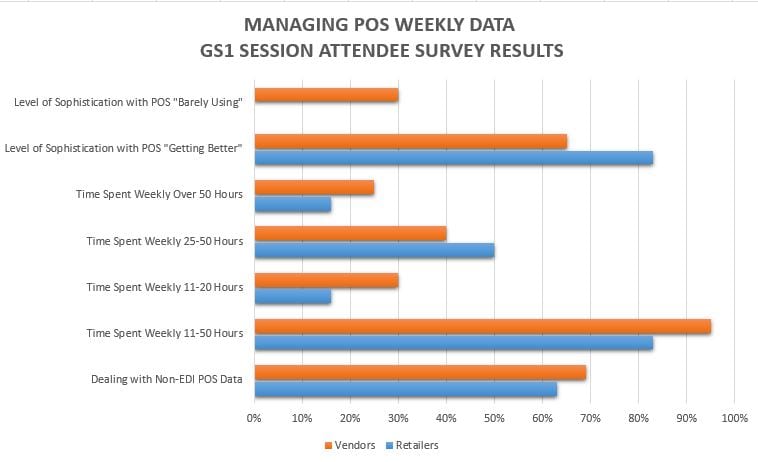

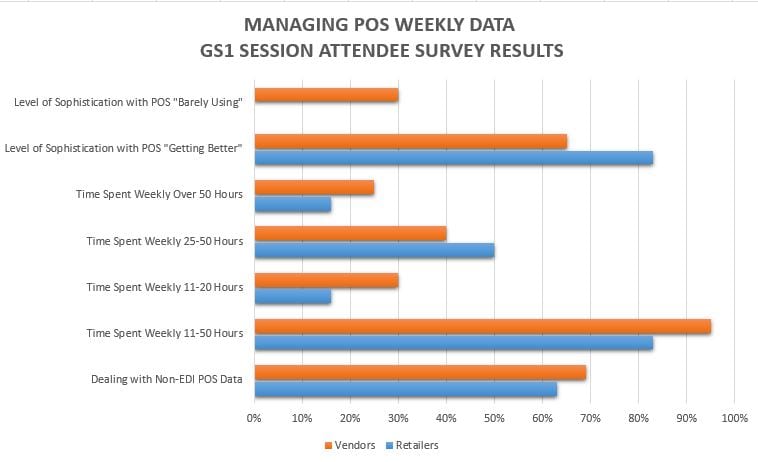

Some interesting, yet not surprising, statistics were gathered from the retailers and vendors represented in the room. When asked about managing their POS data week to week, 66% were using POS data that was not provided via an EDI 852 file, eliminating their ability to automate the collection and processing of the data electronically, and instead having to work with multiple sources and formats of data. This process of data management and then trying to create usable reports to have meaningful partnership conversations between retailer and vendor is extremely time consuming: 83% of the retailers in the room spend 11-50+ hours per week managing and processing their POS data. More staggering was 95% of the vendors in the session were spending 11-50+ hours per week: 30% spending 11-20 hours, 40% spending 25-50 hours and 25% over 50 hours per week!

The good news is over half of the attendees in the room felt they are getting better at managing and using POS data each week, but 30% still admit to ‘Barely Using’ their POS data. Recognizing that heavy resources are needed to use POS data, especially on the vendor side, is making vendors ask, “Do we build an in-house solution to manage this, or outsource it?” Check out our infographic detailing the pros and cons of each, and the differences in resource and financial investment.

Based on the time and effort being made by most of those represented, it is clear that POS data sharing is important for effective collaboration between retailers and vendors to “get it right for the customer”. POS data can be used to not just track units sold overall, but can give product/store level details on out-of-stocks, weeks of supply, sell thru %, average sales, geographic trends, inventory investment and lost sales opportunities. CLICK HERE for our industry sell thru % guidelines infographic.

We need to do everything we can to exceed our customers’ expectations and deliver an outstanding experience for them when they come across our brand. Sharing POS data and then using it to partner together to analyze it will help shape the customers’ experiences and give us inventory visibility and fulfillment across channels to meet customer expectations.

Want to learn more? Contact Jennifer@AcceleratedAnalytics.com to start a conversation. CLICK HERE to download whitepapers on analyzing POS data like a pro.

– Jennifer Freyer, Director of Sales and Marketing, Accelerated Analytics