The second week of April continued to see sluggish retail traffic. According to reports by Citi Research analyst Kate McShane and Cowen and Co. analyst John Kernan, total U.S. retail visits for the week ended April 16 declined 6.58 percent year over year. Total U.S. retail same-store traffic slid 8.75 percent year-over-year for the week while year-to-date retail visits are down 3.4 percent. In a report released this week, Cowen and Co. outline several factors contributing to the decline.

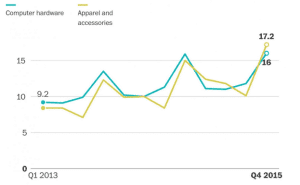

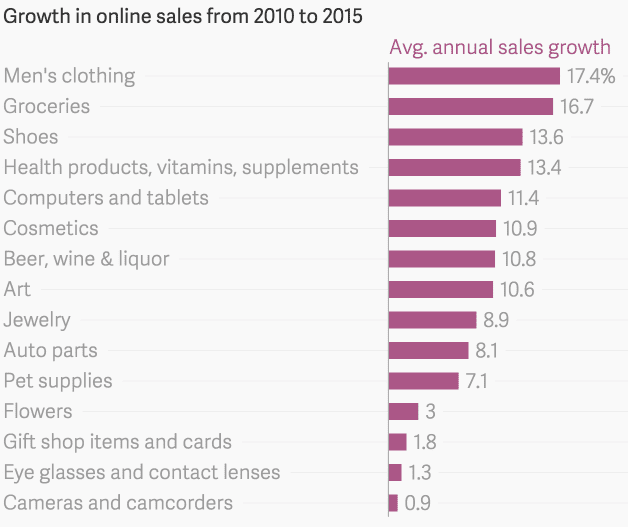

E-commerce and Mobile Growth

According to the Cowen report, holiday e-commerce sales increased about 14%, while mobile currently captures 61% of consumers’ time spent shopping online. The increased competition from e-commerce and the pressure to maintain brick-and-mortar locations contributed to several large retailers filing for bankruptcy in recent months.

Lack of Trends

Retailers continue to be plagued by what Cowen and Co. termed “product malaise”. Either brands and retailers are not creating /offering enough fresh and exciting product to compel consumers to spend, or consumers simply aren’t as interested in purchasing “stuff” these days.

Election Year Politics

Retailers have notoriously blamed sluggish traffic and sales during an election year on the hype and uncertainty surrounding a presidential election. The campaigns and debates may draw attention away from retail shopping, plus high-end shoppers may scale down their spending before an election if they fear an increase in taxes when the next president takes office.

One tactic vendors and retailers can use to weather the storm is remaining focused on inventory and consumer buying trends using POS data and analytics. Research continues to show that when people find a product that they really like, they will buy it. With comprehensive data and reports readily available, vendors can make informed decisions that help ensure their customers can find and buy their product.

Source: footwearnews.com

The Voice of the Store Associate Survey found that over half of respondents feel only somewhat prepared to staff appropriately to meet customer demands. They rely primarily on outdated forms of scheduling, like pen and paper, whiteboard or an Excel spreadsheet, and have yet to develop and deploy a modern workforce management (WFM) solution into their planning process.

The Voice of the Store Associate Survey found that over half of respondents feel only somewhat prepared to staff appropriately to meet customer demands. They rely primarily on outdated forms of scheduling, like pen and paper, whiteboard or an Excel spreadsheet, and have yet to develop and deploy a modern workforce management (WFM) solution into their planning process. Swedish retailer H&M recently revealed its aggressive plans for both physical and digital growth in 2016. The company will open its 4000th location when they add 425 stores this year. H&M also plans to expand its e-commerce efforts to Japan and 10 other markets.

Swedish retailer H&M recently revealed its aggressive plans for both physical and digital growth in 2016. The company will open its 4000th location when they add 425 stores this year. H&M also plans to expand its e-commerce efforts to Japan and 10 other markets. But, Walmart has acknowledged a shift in the way it runs the company. They’ve moved away from their previous focus on net sales and cutting operating expenses as a percentage of sales, and are now focused on making “strategic investments” to support the “long-term health of the company.”

But, Walmart has acknowledged a shift in the way it runs the company. They’ve moved away from their previous focus on net sales and cutting operating expenses as a percentage of sales, and are now focused on making “strategic investments” to support the “long-term health of the company.”