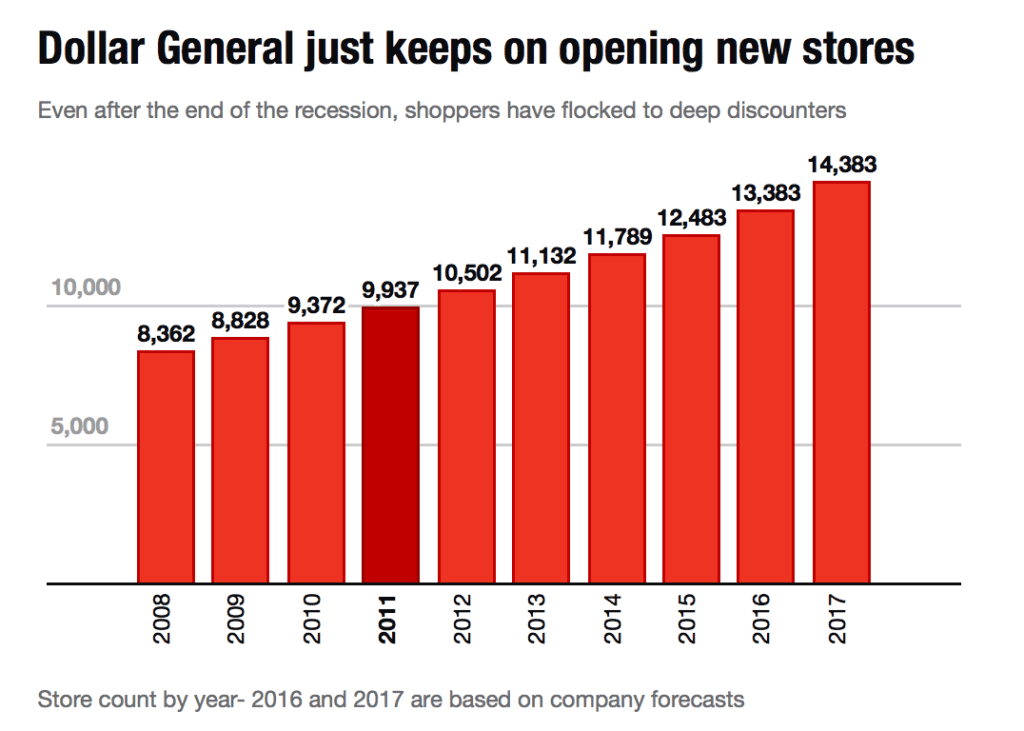

In an era when e-commerce is growing and chains like Kohl’s, Macy’s and Staples are closing stores, Dollar General is expanding. At it’s annual investor day last Thursday, the discount chain announced it will open 900 new stores this year and plans to open another 1,000 in 2017. Adding 1,900 new stores will bring Dollar General’s store count to over 14,000.

Last year was Dollar General’s 26th straight year of same-store sales growth and they have added new stores consistently for the past 8 years, growing from 8,362 locations is 2008 to nearly 12,500 by the end of 2015.

Last year was Dollar General’s 26th straight year of same-store sales growth and they have added new stores consistently for the past 8 years, growing from 8,362 locations is 2008 to nearly 12,500 by the end of 2015.

In the late 2000’s, as the economy rebounded from the recession, deep discount retailers like Dollar General, Dollar Tree and Family Dollar exploded in popularity as consumers sought discounted items at no-frills stores located close to home so they could save on gas. Consumer’s frugal spending habits have continued and Dollar General is targeting annual sales growth of 7% to 10%.

Despite an expected snow storm in the mid-Atlantic States and New England, consumer spending and apparel sales should both rise as the weather improves, according to analytics firm Planalytics. In its weekly report, Planalytics said that warmer weather is resulting in “many consumers thinking and purchasing spring. The warming conditions during the Easter run-up period will help drive demand for seasonal apparel as well as live goods.” Looking ahead, the analytics firm said, “western locations can expect strong gains for both spring apparel and consumables.

Despite an expected snow storm in the mid-Atlantic States and New England, consumer spending and apparel sales should both rise as the weather improves, according to analytics firm Planalytics. In its weekly report, Planalytics said that warmer weather is resulting in “many consumers thinking and purchasing spring. The warming conditions during the Easter run-up period will help drive demand for seasonal apparel as well as live goods.” Looking ahead, the analytics firm said, “western locations can expect strong gains for both spring apparel and consumables. Last year, Wall Street firm Cowen & Co. famously predicted that Macy’s would be be dethroned by Amazon.com as the top apparel retailer in the U.S. But Macy’s CEO Terry Lundgren believes that Macy’s nearly 800 stores offer a huge advantage over Amazon. He noted that shoppers typically order multiple sizes of the same piece of clothing, keep the one that fits, and send the rest back.

Last year, Wall Street firm Cowen & Co. famously predicted that Macy’s would be be dethroned by Amazon.com as the top apparel retailer in the U.S. But Macy’s CEO Terry Lundgren believes that Macy’s nearly 800 stores offer a huge advantage over Amazon. He noted that shoppers typically order multiple sizes of the same piece of clothing, keep the one that fits, and send the rest back.

It seems that sporting goods retailers are in a slump. Last week The Sports Authority filed for bankruptcy and said it will close nearly a third of it’s 450 stores over the next three months. It ha not yet been disclosed which stores will close. Bankruptcy has been looming since January when the retailer disclosed that it had missed a $20 million debt payment.

It seems that sporting goods retailers are in a slump. Last week The Sports Authority filed for bankruptcy and said it will close nearly a third of it’s 450 stores over the next three months. It ha not yet been disclosed which stores will close. Bankruptcy has been looming since January when the retailer disclosed that it had missed a $20 million debt payment.

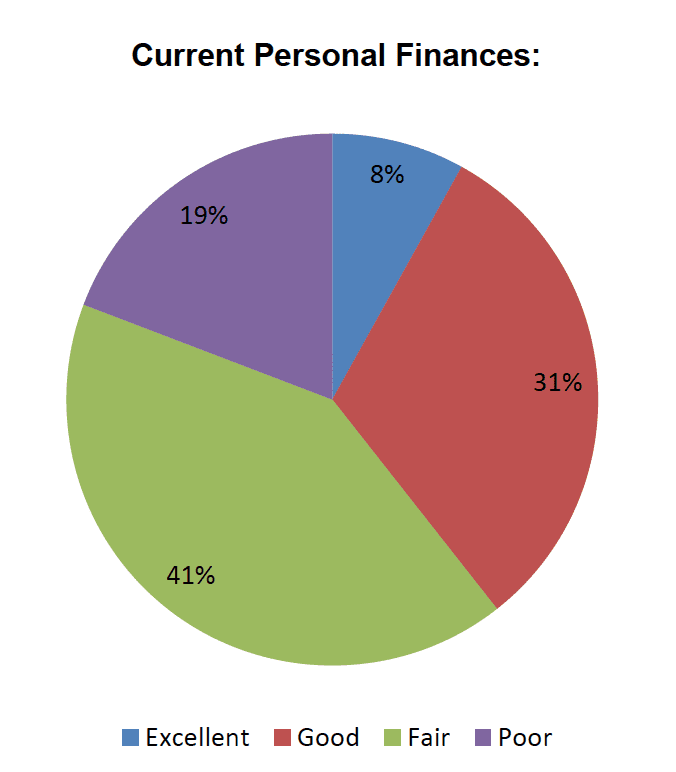

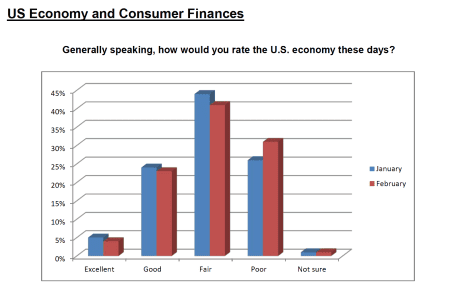

According to data from Chain Store Guide’s Consumer Spending Report, the month of March is likely to see a slowdown in consumer spending. While current economic reports are varied, the unpredictable stock market and upcoming elections have likely created unease among consumers.

According to data from Chain Store Guide’s Consumer Spending Report, the month of March is likely to see a slowdown in consumer spending. While current economic reports are varied, the unpredictable stock market and upcoming elections have likely created unease among consumers.

Last Thursday, J.C. Penney announced impressive increases in same-store sales and earnings, as well as a new marketing campaign called Penney Days.

Last Thursday, J.C. Penney announced impressive increases in same-store sales and earnings, as well as a new marketing campaign called Penney Days.