Inventory carrying cost, also referred to by carrying costs, is a term used in accounting that identifies all business expenses related to storing and holding unsold goods. This total figure would include all related costs of warehousing, salaries, transportation, handling, taxes, and insurance as well as depreciation, shrinkage, and opportunity costs.

If you’re a retail business owner, you likely already know how important inventory management is to the success of your company. If you’re a regular reader here at Accelerated Analytics, you’ve likely be learning which retail metrics you should be tracking, especially those metrics that come from your POS data.

Now, there’s a few key points we want to make before you get into the carrying cost formula.

- Inventory carrying cost is the total of ALL expenses related to storing unsold items.

- This total will include intangibles such as opportunity cost and depreciation.

- Inventory carrying cost generally average around 20-30 percent of total inventory cost.

Before you can calculate that cost, there’s a few terms you need to know.

- Storage Cost – This is going to be all the cost associated with storing inventory. This can include rent, taxes, fees, insurance and utilities for storage. If you need controlled storage or climate storage, that would included too.

- Handling Cost – If you have people shelving your products or items are being watched, you need to make sure you total these cost.

- Opportunity Cost – If you purchase $50,000 in inventory, that means you can’t use that $50,000 for debt or investing. This metric is going to represent the cost of lost opportunity when calculating the cost of carrying inventory.

- Deterioration / Obsolesence – If you carry inventory long enough, some items can depreciate in value.

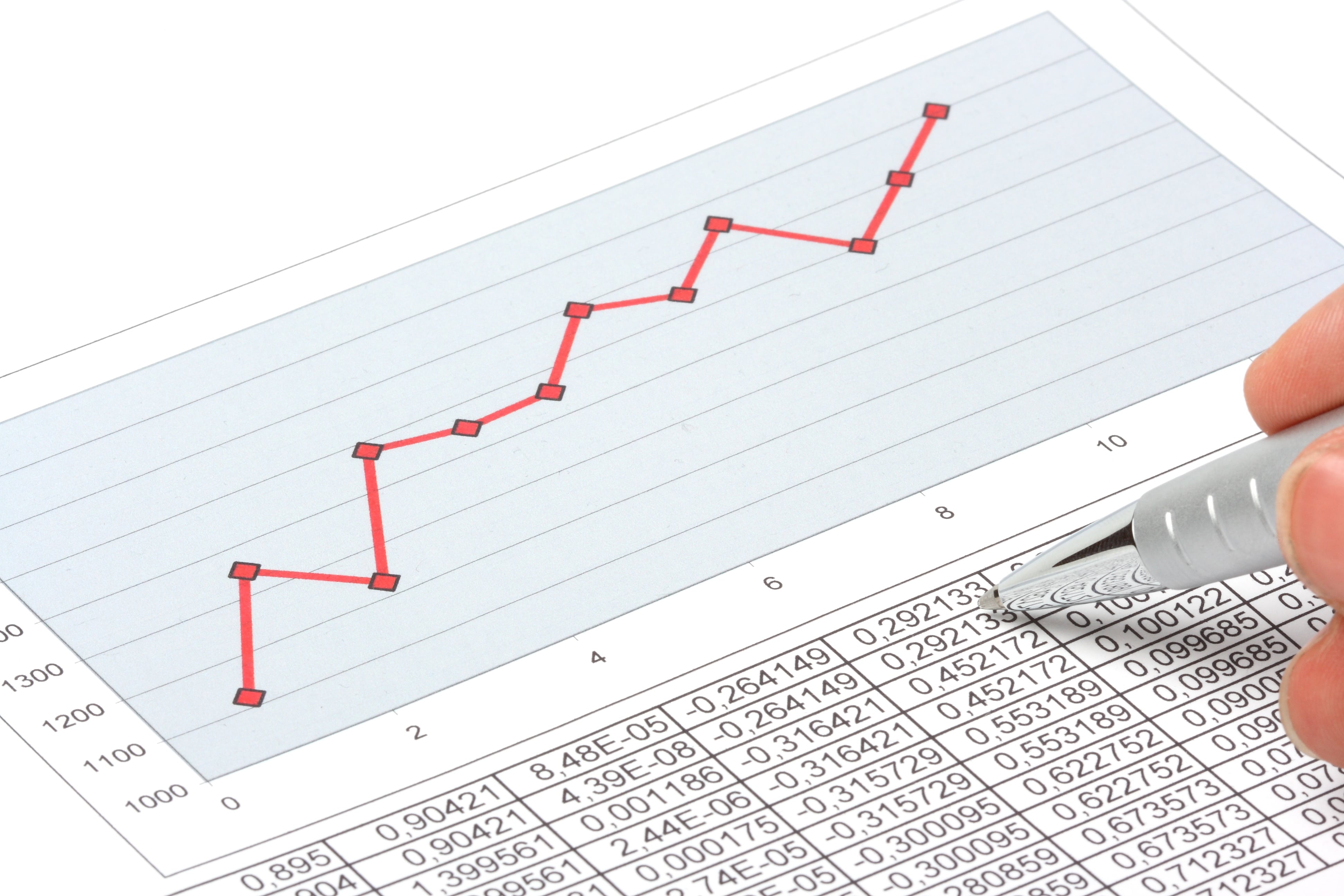

How Do You Calculate The Cost Of Inventory?

To use an example, we’ll say we have a retail coin shop that sells collectible coins, gold and silver.

- The average value of this year’s inventory is $500,000.

- Our annual cost of storing goods are $100,000.

- Our cost for unloading storage and bringing it to the store is $5,000.

- Our opportunity cost is $20,000 as it was tied up in inventory.

Our inventory carrying cost above add up to $125,000, which include our cost for storage, unloading/delivery and opportunity cost. To calculate carrying cost, we divide $125,000 by $500,000 and our carrying cost is 25 percent.

Controlling Carrying Costs

If you’re a retailer yourself, you already know inventory is a major expense, it’s an important retail KPI. You can lower them by reducing the cost of warehouse labor or finding a cheaper place to store goods. Another solution is to achieve better control of your inventory.

Achieving the ideal level of inventory is a challenge, we understand that. If you have too much inventory, carrying costs are going to go up. If you have too little inventory, you lose sales from not having those items available. It’s a double edged sword you have to balance.

Even so, that doesn’t mean you can’t control your inventory better, that doesn’t mean you can’t reduce your cost. We’ve talked about inventory control many times on the blog. You can figure the right amount by utilizing forecasting software or analyzing your past sales records. A great start would be using our POS reporting and EDI 852.

We want to give you a few tips to better control your inventory carrying cost.

- Identify your reorder point. If your past sales data shows holiday shopping begins in October, there’s no point in ordering all your holiday-related items in March. Why would we do this? We wouldn’t, we’d be paying months of storage cost and expenses.

- If your supplier is pushing you, we’ll say a minimum $10,000 order and you don’t need that amount, try to negotiate a better deal. All they can tell you is no, right? You might be in a better position paying a premium on a smaller quantity. Even so, you could potentially work with other stores to make a joint order that meets the minimum. Always shop around and keep your opportunities open.

- Always be careful of “discounts.” A discount offer for a large order may sound like a good idea but it’s not a good deal if those items are just sitting on your shelves. Be smart buying your inventory.

- If you have items in storage that just aren’t moving, selling them at a big discount or donating them to charity might be a good way to cut your carrying costs. If your expenses are adding up and that product is not going anywhere any time soon, get rid of it!

When you have the right reporting in place and you can make educated based decisions to grow your business, the sky is the limit. You need the right tools in retail to win and Accelerated Analytics has them. If you’re trying to grow sales and you’re not reaching your potential, let’s jump on a quick call. Your competition is focusing on analytics and reporting to grow, you better be too. Get started here.

*Accelerated Analytics publishes resources like this to provide insights to different analytical metrics, data points and formulas. Please be aware, we’re not claiming that our POS reporting services will offer this example or any other metric, data point or formula. To learn exactly what our reporting covers, please feel free to schedule a demo or give us a call. Thanks for understanding.