COVID-19 Retail Industry Updates

For the retail industry and those responsible for their brand’s POS data, supply chain, and retail sales analytics, COVID-19 has become an unwanted, but apparently long-reserved guest. As we all work to better understand the virus and the various ways it will impact our industry ahead, we wanted to share the best peer articles and conversations we’re a part of. This will be a running log, so be sure to bookmark this page above. Have a suggestion for us to look into? Contact our team at sales@acceleratedanalytics.com. For your immediate convenience, here are some quick resources:

July 1, 2020 COVID-19 Updates

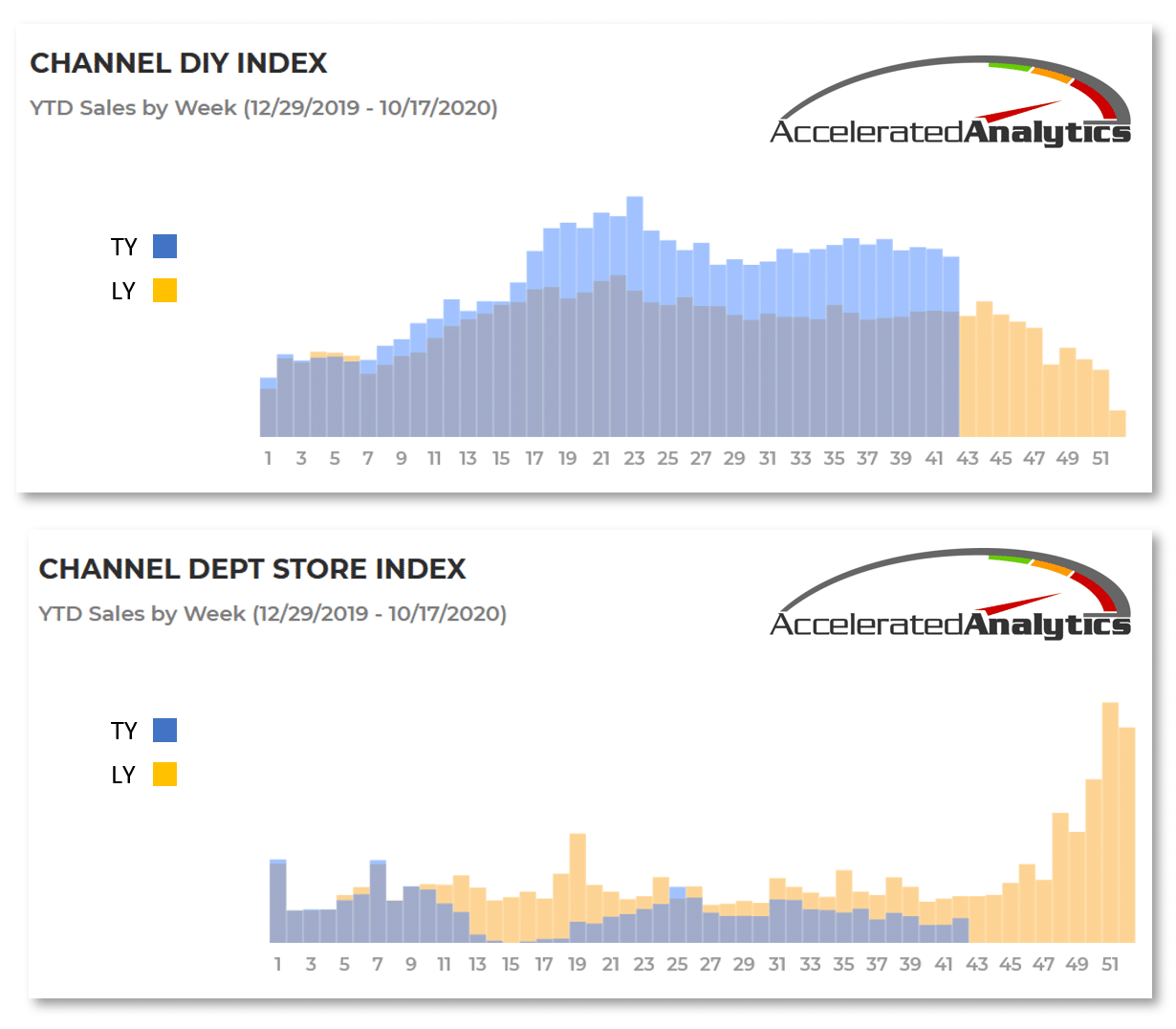

Macy’s reported a first quarter adjusted loss per share of $2.03 on revenue of $3.02 Billion. Macy’s revenue for the first quarter last year was $5.50 billion. A decrease year over year of -45%. When asked if recent increase in COVID-19 cases is a cause for concern, CEO Jeff Gennette said “We do not anticipate another full shutdown, but we are staying flexible and are prepared to address increases in cases on a regional level”. As of June 1 Macy’s had approximately 450 store reopened, with the majority reopened in the their full format.

June 26, 2020 COVID-19 Updates

Saks Fifth Avenue has reopened all 40 of its stores including the flagship store in New York City. President Marc Metrick said “We’re still seeing the traffic there,” he said. “We talk to our store, our teams everyday and they’re telling us they’re really not feeling it or seeing it in traffic or even in the attitude and the sensibilities in how they’re shopping.” Metrick also said that Sak’s has not changed in merchandising mix due to COVID-19. “We are in the unknown right now,” he said. “We have to wait. We have to get through this period. We have to start getting to the next normal to understand.” – Source: https://www.cnbc.com/2020/06/25/saks-fifth-avenue-says-traffic-hasnt-dropped-as-coronavirus-cases-rise.html

June 3, 2020 COVID-19 Updates

Von Maur announced today that all of their retail storefronts will be opening tomorrow (June 4, 2020). Original announce document available here.

“On June 4th, Von Maur will have 100% of our stores open in the communities that we serve. I am grateful for the response we have received from customers and appreciate your ongoing support of Von Maur. Together, we are upholding the practices that we know will help to ensure the safety of everyone in our communities. Just as we had to weigh the decision to open, individuals have to weigh their personal decision to visit our stores.”

May 18, 2020 COVID-19 Updates

May 14, 2020 COVID-19 Updates

May 13, 2020 COVID-19 Updates

May 6, 2020 COVID-19 Updates

May 5, 2020 COVID-19 Updates

May 4, 2020 COVID-19 Updates

May 1, 2020 COVID-19 Update

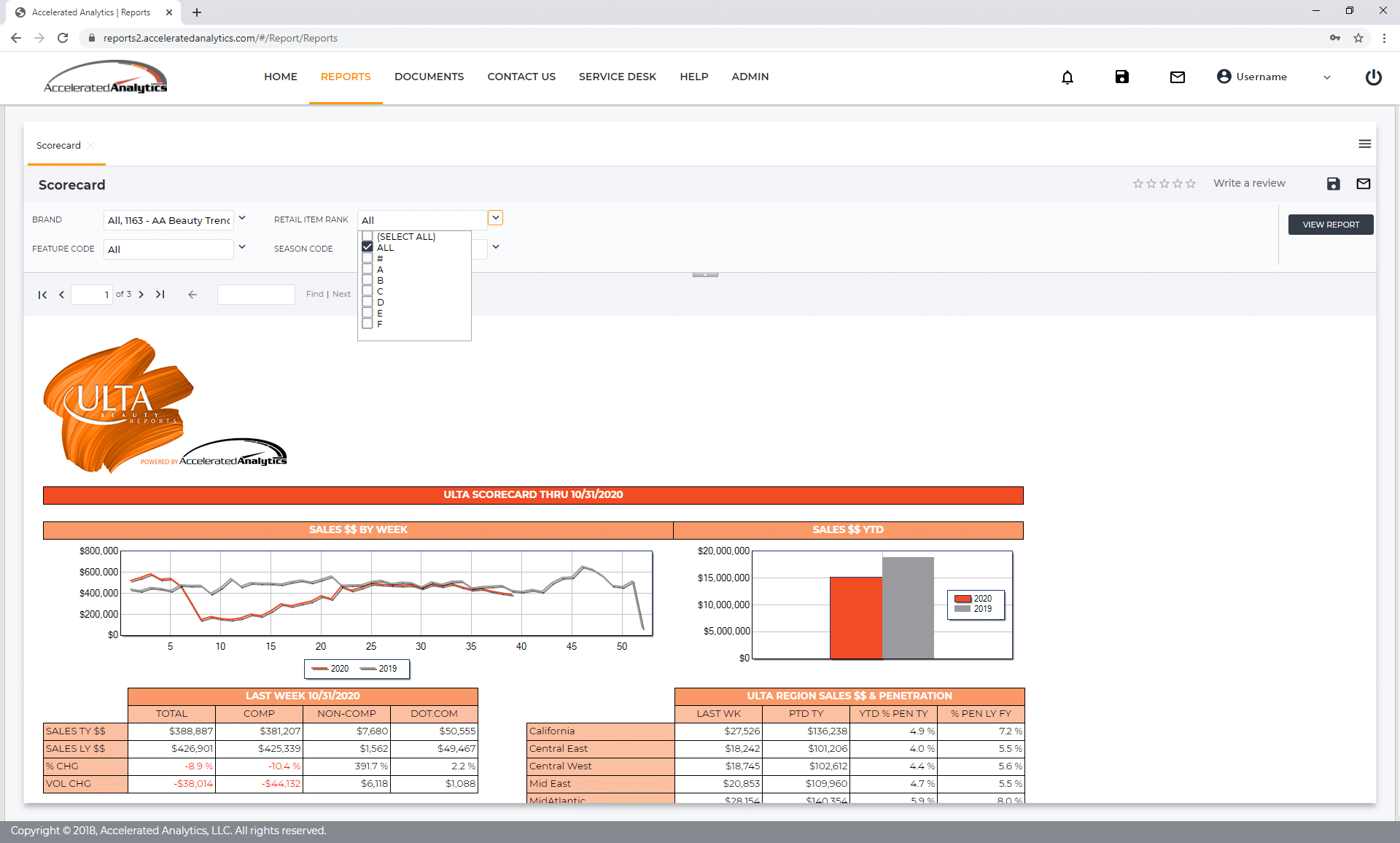

Ulta CEO Mary Dillon announce yesterday Ulta will begin curbside pick up in select stores. The curbside pick up offering is an extension of the buy on line pick up in store service. More than 350 stores will participate. More here: http://ir.ultabeauty.com/news-releases/news-release-details/2020/A-Message-to-Ulta-Beauty-Guests-about-the-Coronavirus-From-CEO-Mary-Dillon/default.aspx

Dillard’s Announces it will Re-Open 55 stores. The stores will open on Tuesday May 5th in Arkansas, Colorado, Florida, Georgia, Mississippi, Missouri, Oklahoma, South Carolina, Texas, and Utah. More here: https://investor.dillards.com/press-releases/press-release-details/2020/Dillards-to-Re-Open-Stores/default.aspx

April 30, 2020 COVID-19 Updates

April 29, 2020 COVID-19 Updates

April 28, 2020 COVID-19 Updates

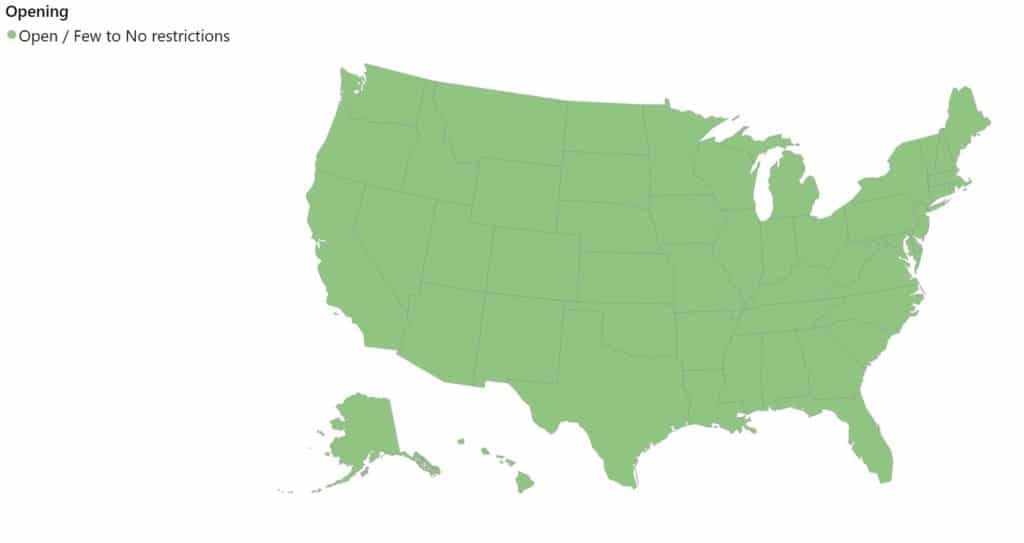

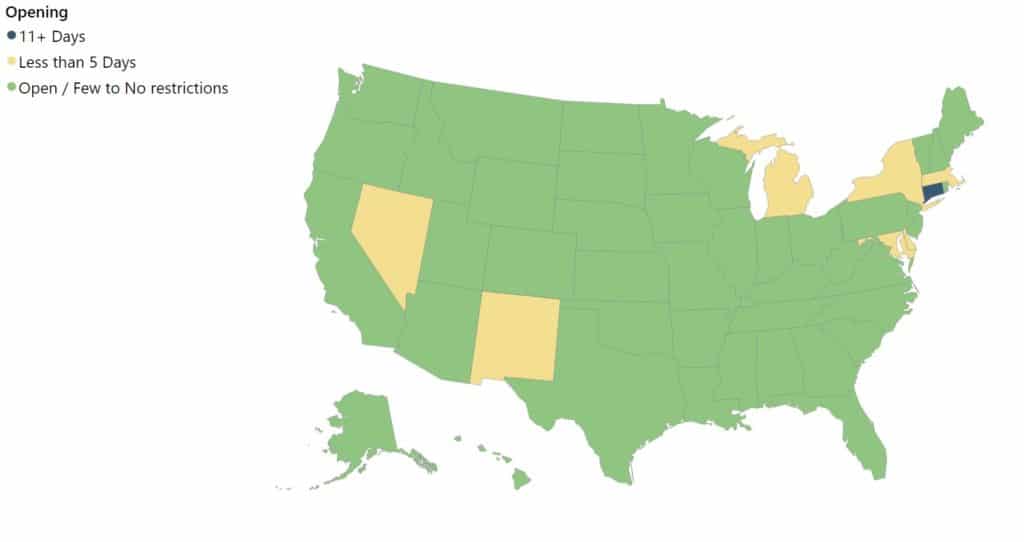

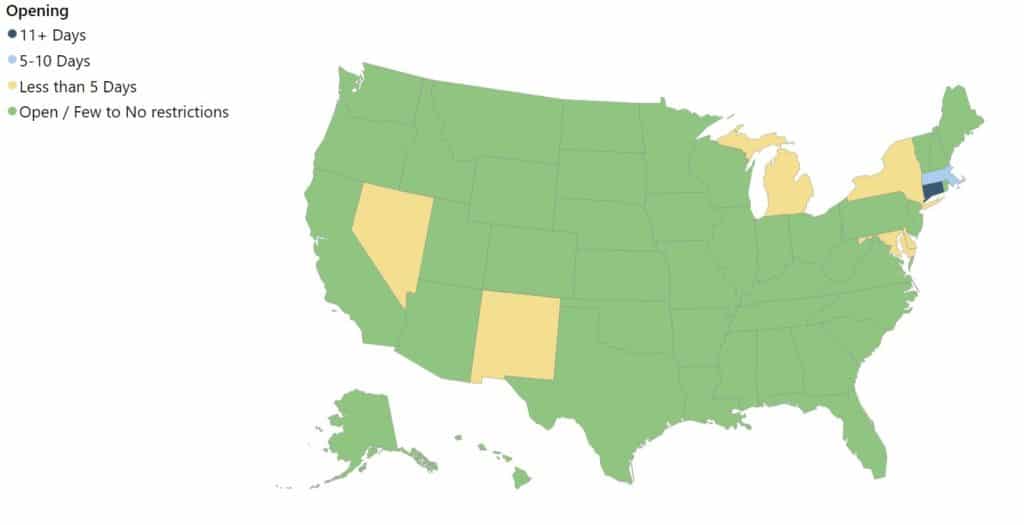

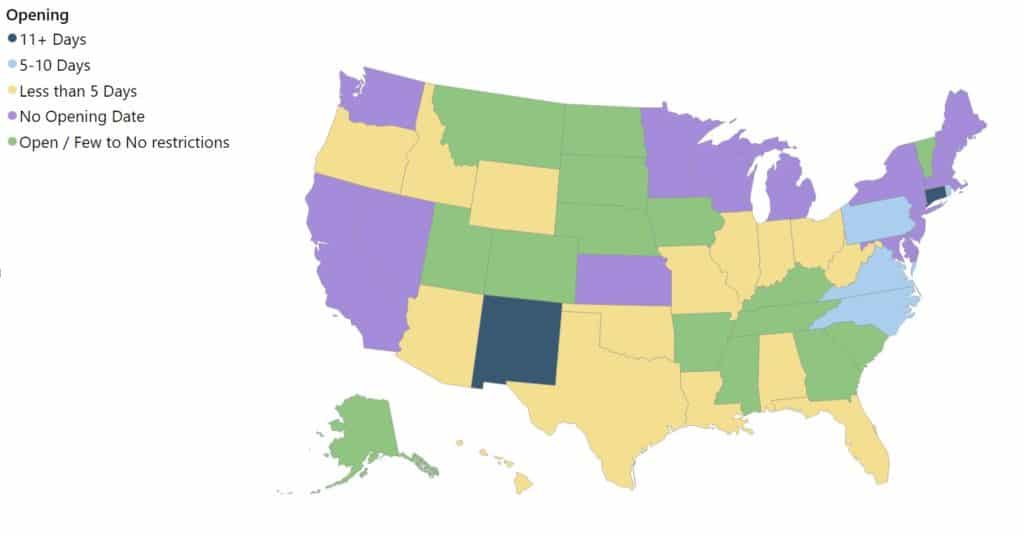

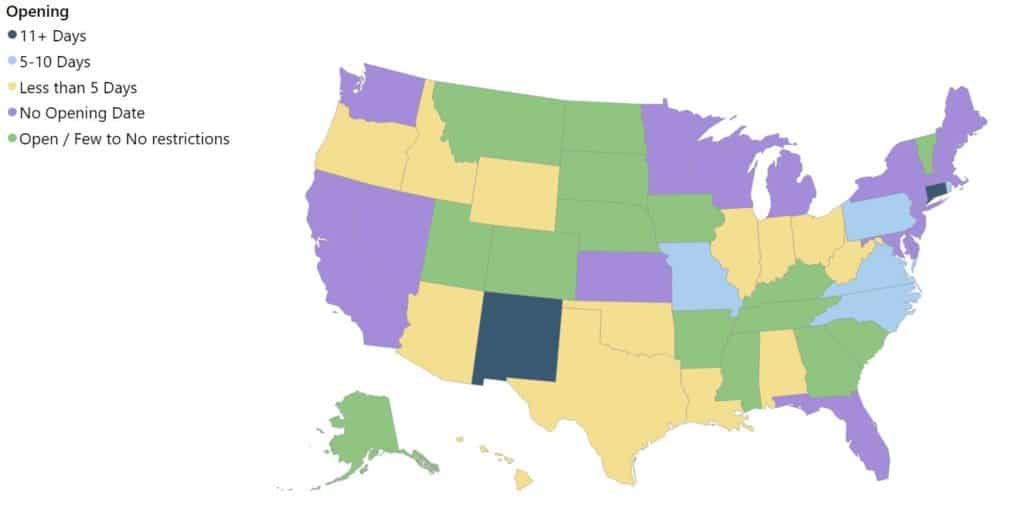

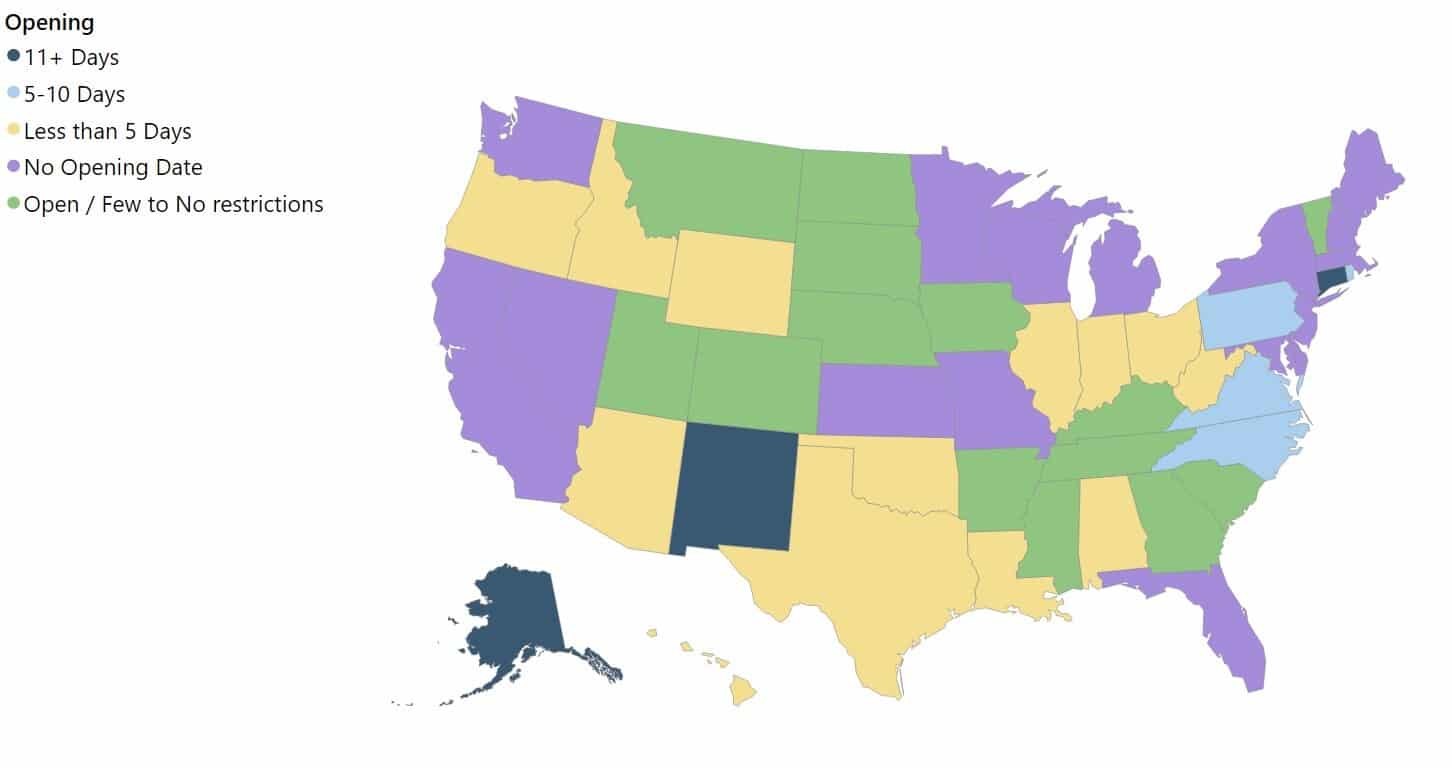

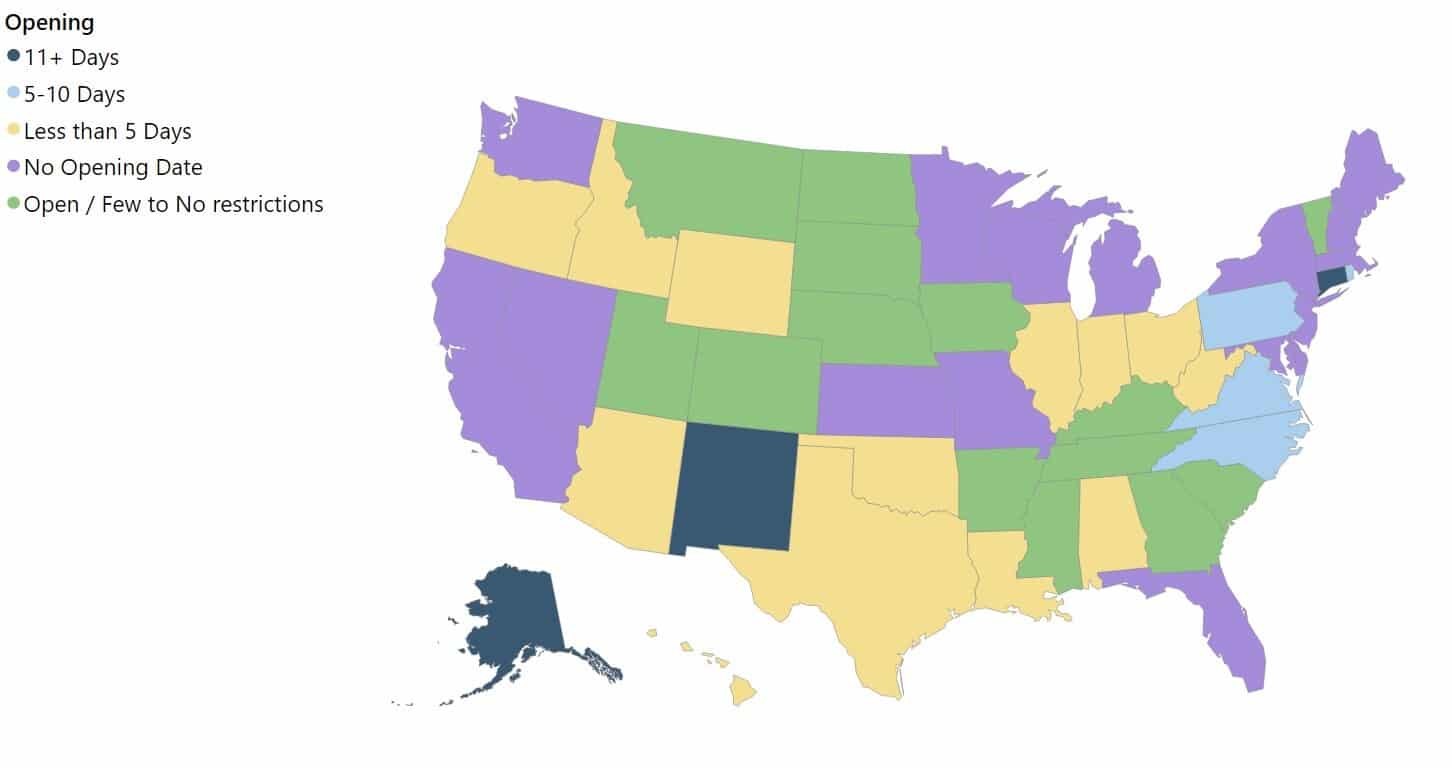

State Governors are starting the process of lifting restrictions. As of Monday, Alaska, Montana, Colorado, Oklahoma, and Mississippi have joined Georgia in lifting restrictions and starting the process to reopen. Texas Gov. Greg Abbot announced on Monday he will allow his stay at home order to expire on Thursday April 30.

The National Retail Federation has posted a plan for retailers to reopen stores called Operation Open Doors. More information can be found here: https://nrf.com/resources/operation-open-doors

The SBA started phase II of the PPP loan program Monday. Jovita Carranza, SBA Administrator noted that as of 3:30 pm EDT Monday the SBA had processed more than 100,000 loans submitted by more than 4,000 lenders. Earlier in the day the SBA faced criticism over slow response times and system capacity issues.

April 27, 2020 COVID-19 Updates

The SBA will begin accepting new Payroll Protection Program (PPP) loans at 10:30 am today. More information is available on the SBA and Treasury websites.

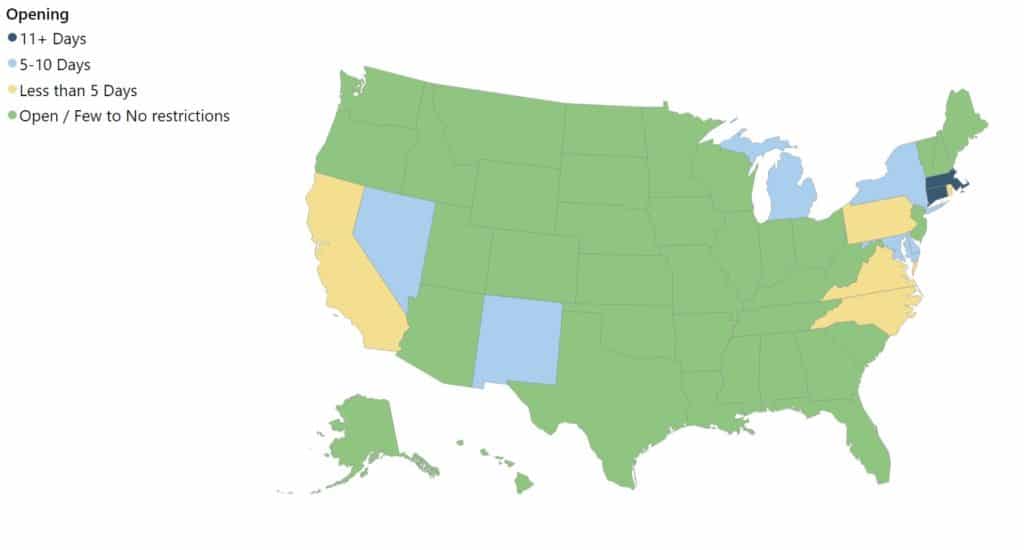

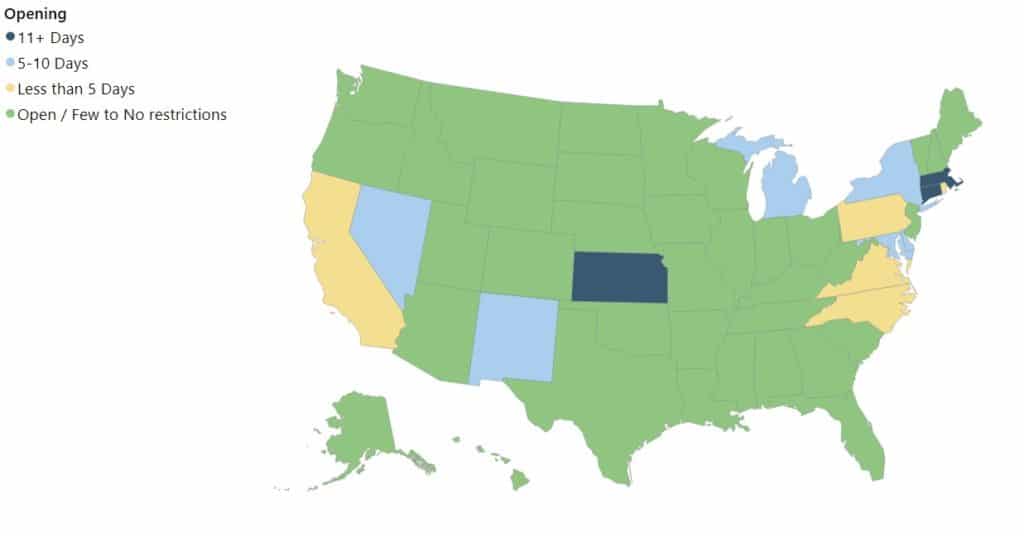

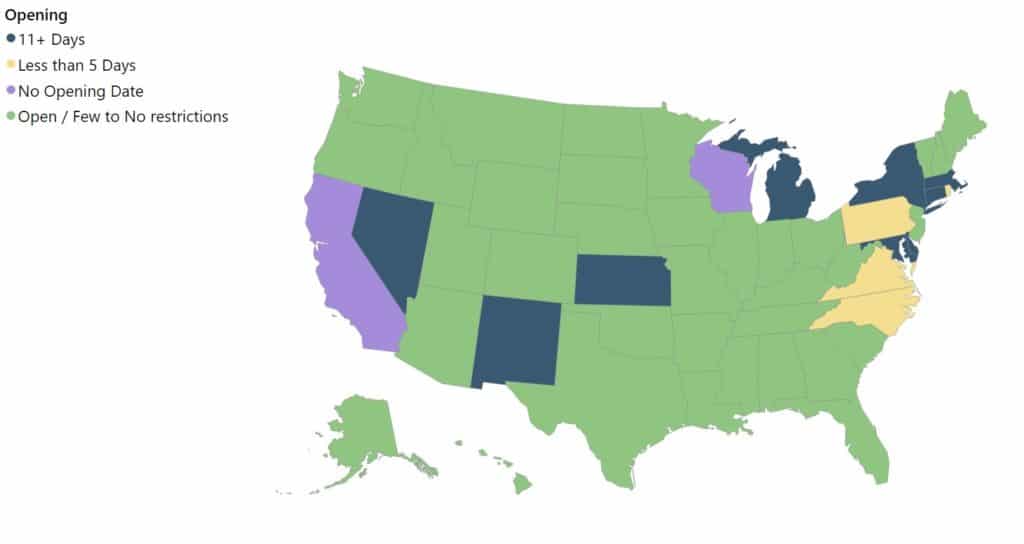

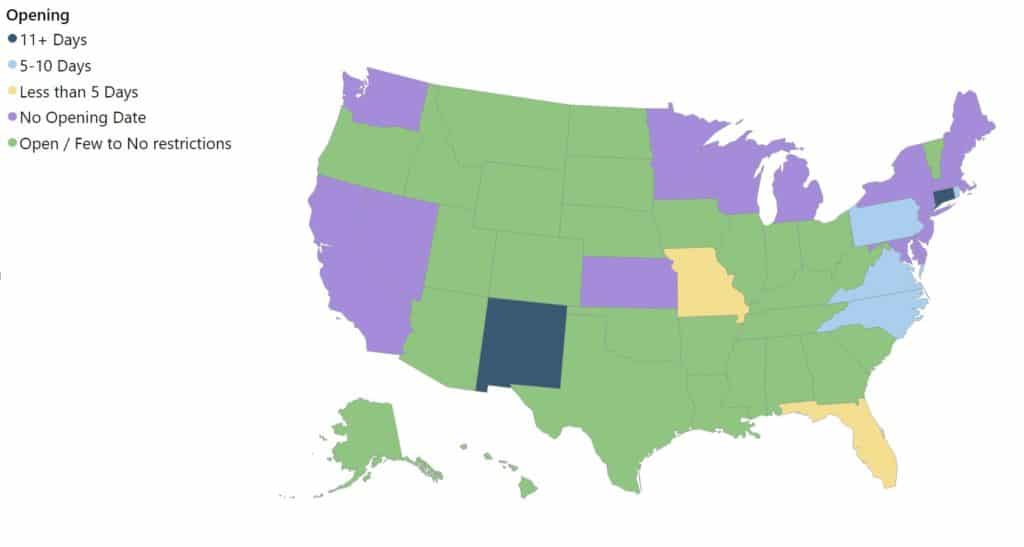

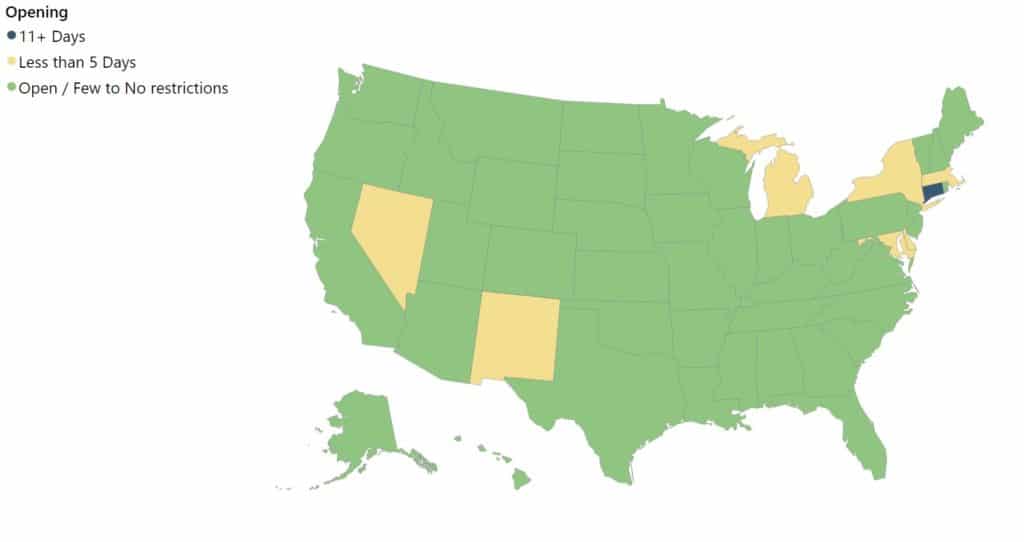

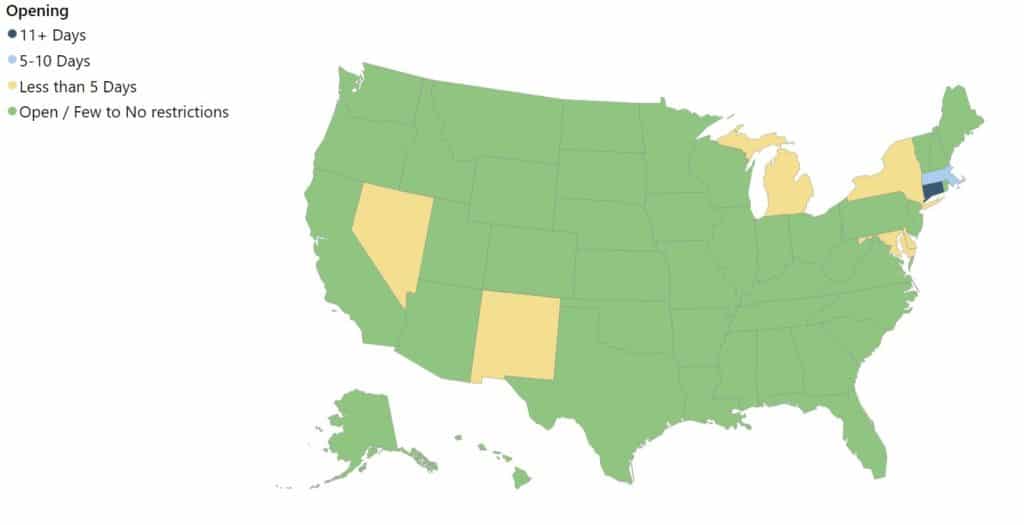

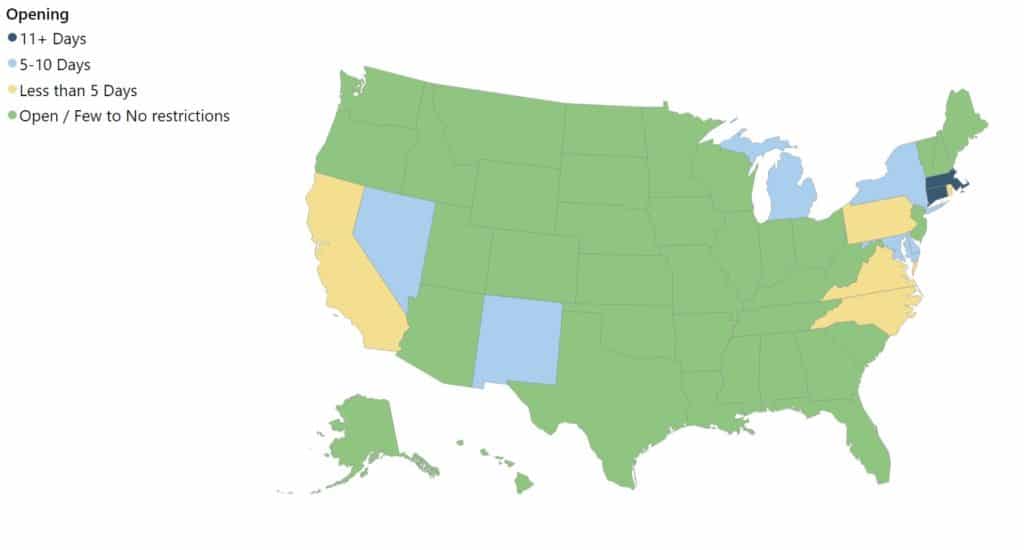

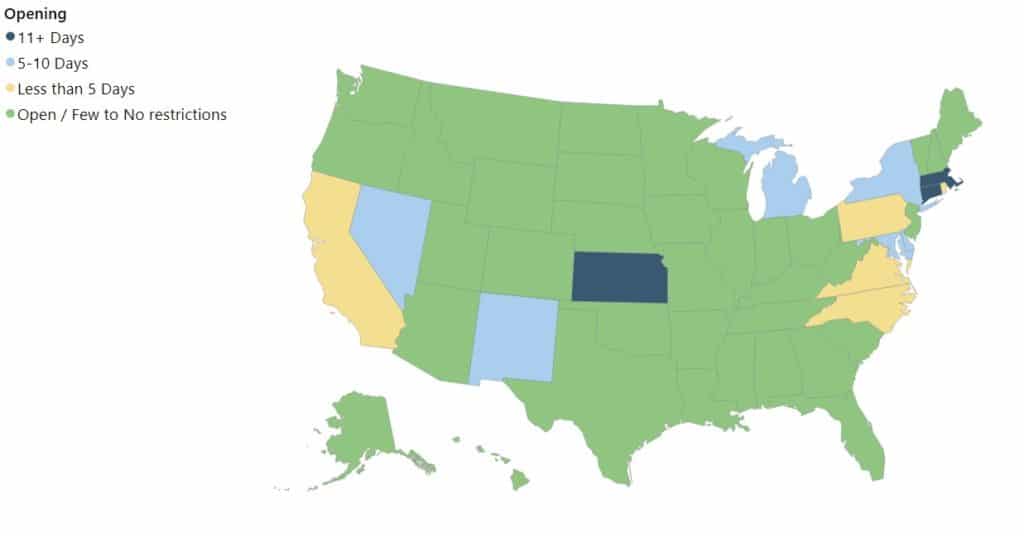

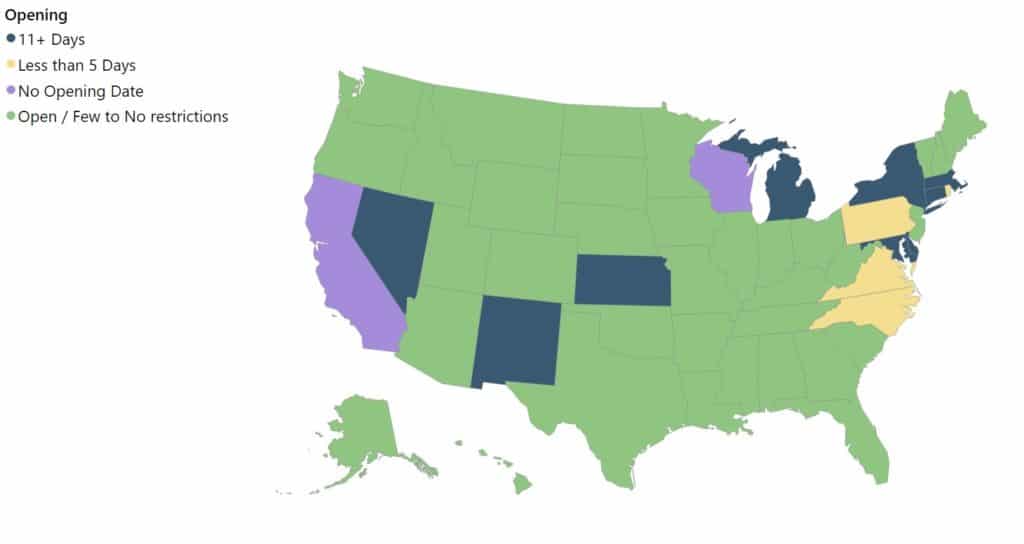

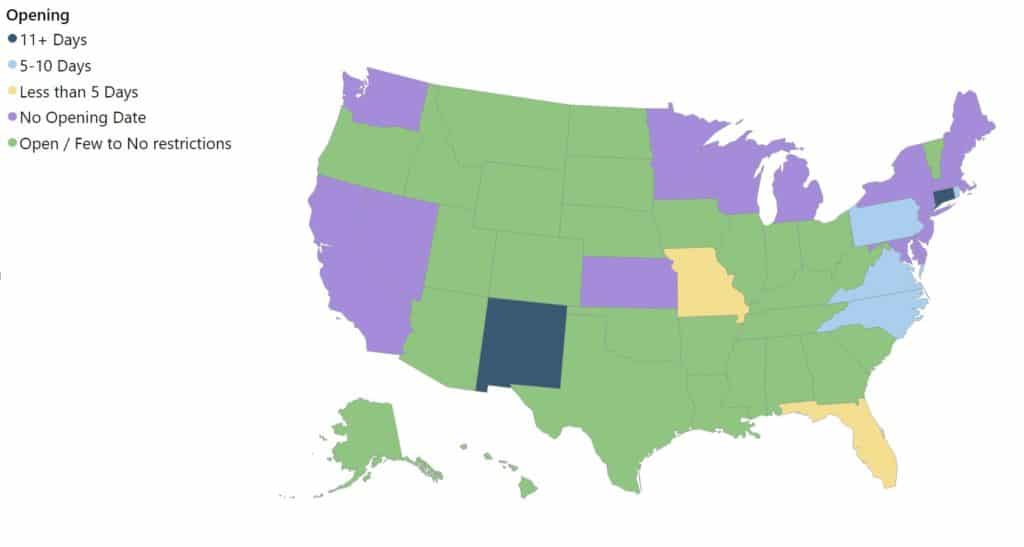

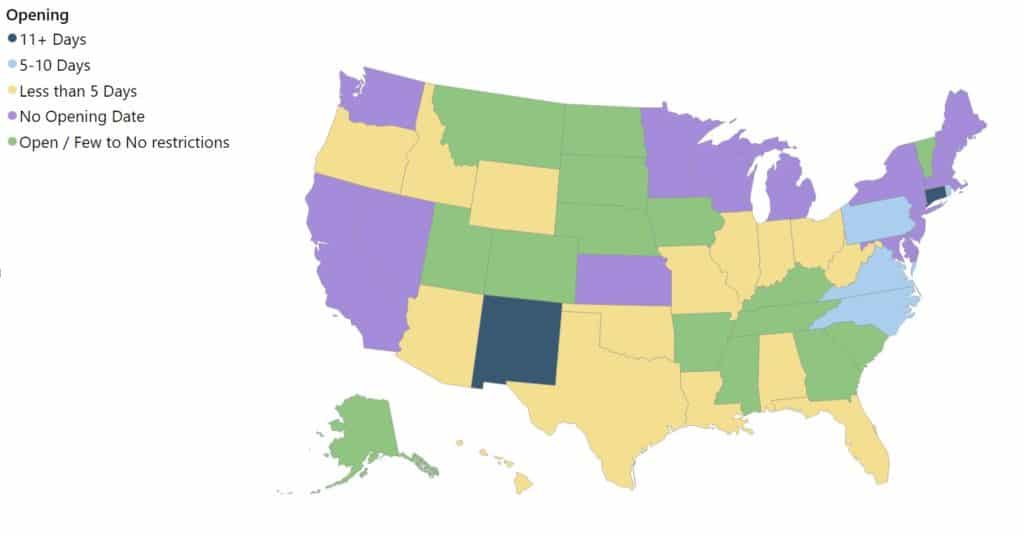

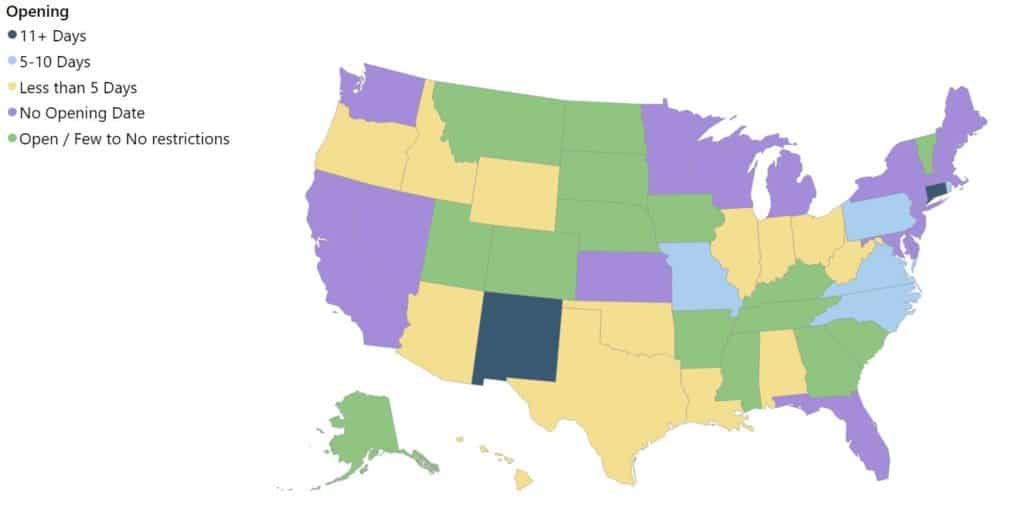

As states begin to reduce restrictions and retail is able to reopen it will be critical to watch inventories and react quickly to avoid out of stocks. The Accelerated Analytics team is currently building resources to track re-opening’s by state and then within each state the key stores based on volume you should be watching to maximize sales. Pre-planning for monitoring and replenishing high volume stores will be critical to success. Continue to monitor this resource page for additional updates and tools.

April 20, 2020 COVID-19 Updates

The state of Georgia is set to start reopening today. The first large state to do so. Here are some other important retailer announcements we’re tracking:

- J.C. Penny Co: According to multiple reports JCP is an advanced bankruptcy funding talks with a group of lenders. This is after JCP missed an interest payment on April 15 which started a 30-day grace period.

- The Neiman Marcus Group: Reporting to be in advanced bankruptcy discussions with creditors.

- Le Tote: Le Tote is a subscription clothing company that acquired Lord & Taylor in 2019 from Hudson’s Bay. Le Tote let go the entire Lord & Taylor executive team and suspended payment to all vendors for at least 90 days. Most industry observers expect Lord & Taylor to be liquidated and to not reopen.

- Macy’s: Macy’s announced it will shutter up to 20% of its store permanently even after furloughing 150,000 of its staff. Macy’s has also announced they intend to sell their Blue Mercury stores.

April 15, 2020 COVID-19 Updates

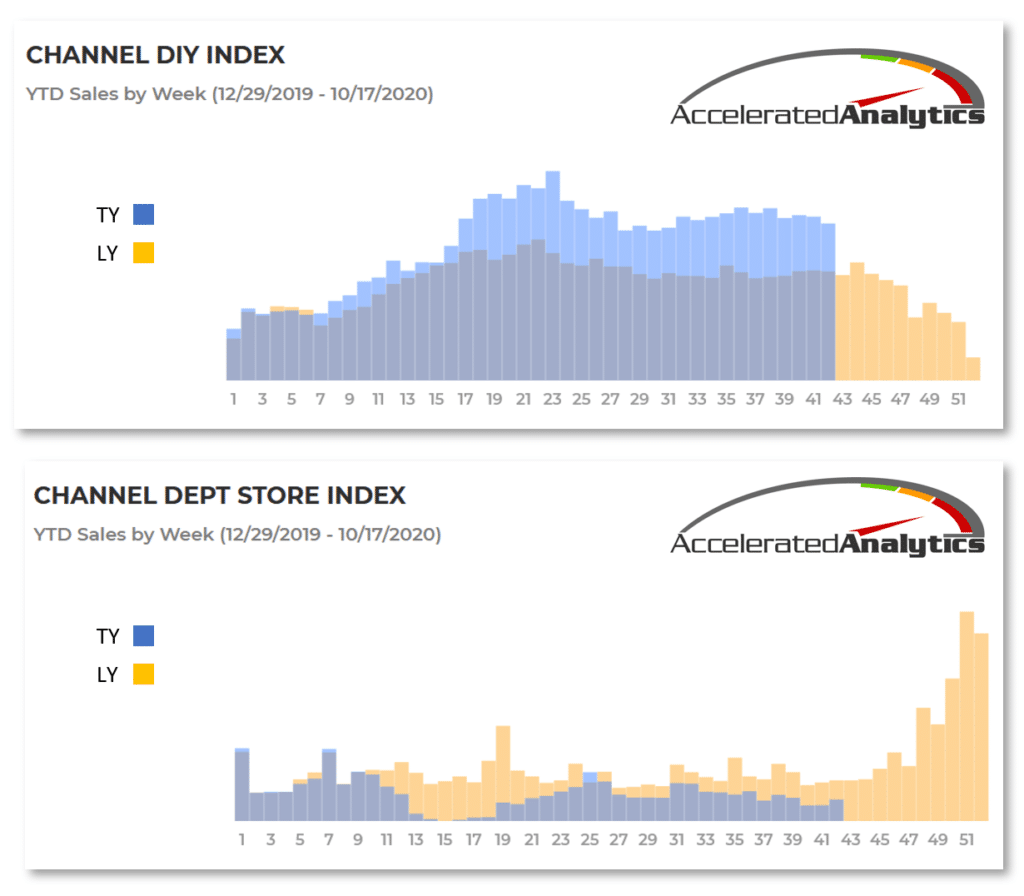

The U.S. Census Bureau report shows overall retail sales during March were down 8.7 percent seasonally adjusted from February and down 6.2 percent unadjusted year-over-year. That is the largest monthly drop ever recorded, including the 4.3 percent decline during November 2008. COVID-19 impact continues to be bifurcated as very brisk up ticks in sales continue at food and drug stores for essential supplies, while nearly all non-essential stores like department stores are closed. More details here: https://www.census.gov/retail/marts/www/marts_current.pdf

Meanwhile the National Retail Federation (NRF) calculation of retail sales, which excludes automobile dealers, gasoline stations and restaurants in order to focus on core retail, showed March was up 1.7 percent seasonally adjusted from February. The NRF report continues with specifics from key retail sectors during March. More details here: https://nrf.com/media-center/press-releases/march-retail-sales-plummet-during-coronavirus-pandemic