The New York Empire Manufacturing Index dropped to -9.02 from April’s positive 9.56 in May, missing estimates for a slight decline to positive 7.0. Stocks reacted negatively to the news, but were offset by gains in the energy and industrial sectors. Domestically oriented US manufacturers are seeing steadier business with bright auto, housing and job markets, while global manufacturers are struggling in markets from Brazil to Europe to China.

“Domestic demand is what has been supporting the manufacturing sector overall and preventing a sharper downturn,” said Gregory Daco, chief U.S. economist at Oxford Economics. “Domestic-oriented sectors are faring relatively well.”

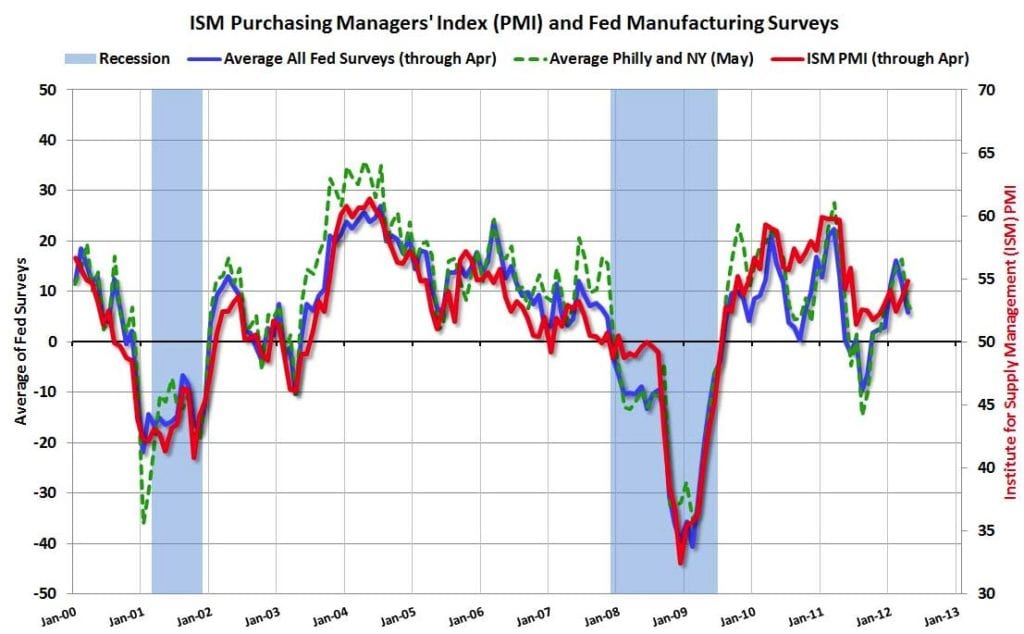

Earlier in May, the Institute for Supply Management also reported its index results, but showed manufacturing activity already falling from March. A strong US dollar and low oil prices, plus weakness overseas, depressed demand for US exports.

The Philadelphia Federal Reserve also reported a decline in its index, reporting that mid-Atlantic manufacturing activity declined for the 8th time in 9 months.

These reports maintain the overall picture of sluggish economic growth, and a newfound possibility that the Federal Reserve could raise interest rates as soon as June.

Sources: WSJ, Nasdaq.com, Investors.com, CalculatedRiskBlog.com