Each month as our team researches and compiles the Retail Industry Briefing Book, different facts and figures stand out, and we inevitably notice trends and patterns in the data we report. Notable this month was the number of macro-economic indexes that are currently on an upward trend, and the 90-day temperature outlook, which was certainly appealing as a large portion of the country was in the midst of a snow-storm this week. But it’s the Small Business Optimism Index that deserves some discussion as we head into the second quarter of 2017.

Each month as our team researches and compiles the Retail Industry Briefing Book, different facts and figures stand out, and we inevitably notice trends and patterns in the data we report. Notable this month was the number of macro-economic indexes that are currently on an upward trend, and the 90-day temperature outlook, which was certainly appealing as a large portion of the country was in the midst of a snow-storm this week. But it’s the Small Business Optimism Index that deserves some discussion as we head into the second quarter of 2017.

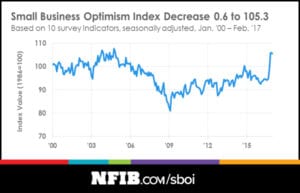

Compiled since 1986 by the National Federation of Independent Businesses (NFIB) via a monthly survey, the Small Business Optimism Index remained at one of its highest readings in 43 years February, as small business awaits new healthcare law, tax reform, and regulatory relief form Washington, according to the NFIB. The index fell 0.6 points in February to 105.3, yet remains very high. The slight decline follows the largest month-over-month increase in the survey’s history in December, and another increase in January.

“It is clear from our data that optimism skyrocketed after the election because small business owners anticipated a change in policy,” said NFIB President and CEO Juanita Duggan. “The sustainability of this surge and whether it will lead to actual economic growth depends on Washington’s ability to deliver on the agenda that small business voted for in November. If the health care and tax policy discussions continue without action, optimism will fade.”

To Duggan’s point, the post-election optimism hasn’t translated into an increase in business spending and hiring yet. Despite some movement in Washington on deregulation and the current administration’s plan to repeal and replace the Affordable Care Act, small businesses want to see more progress on both tax reform and healthcare, according to NFIB Chief Economist William Dunkleberg.

The job openings component reached its highest level since December 2000, but finding skilled workers remains a top issue for 44 percent of businesses, which report few or no qualified workers to fill positions. Also notable, capital spending among small business owners rose two points to 62 percent. This is the second highest reading since 2007, indicative that companies may be starting to invest.

Accelerated Analytics reports on the Small Business Optimism index each month in our Retail Industry Briefing Book (page 14 of the March edition), in addition to over a dozen macro-economic indicators and indexes. You’ll also find stock prices for over 30 major retail brands and retailers, retail sales by sector, weather outlooks and more. The RIBB is a free resource provided to our customers, partners and retail and supply chain professionals. To request the latest copy of the RIBB, simply complete the short form below. Past editions of the RIBB can be found in the Resource Center of our website.