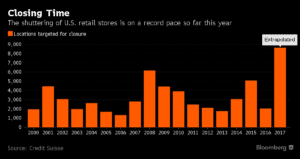

According to a Credit Suisse report released Thursday, 2017 year-to-date store closings have already topped the historical high set in 2008 when the last U.S. recession was raging. About 2,880 stores have closed year to date compared to 1,153 at the same time last year. And since 60 percent of store closures are typically announced in the first five months of the year, Credit Suisse estimates that there could be as many as 8,640 store closings this year.

This week saw stores at both ends of the price spectrum preparing to close their doors. Payless Inc. shoe chain filed for  bankruptcy on Tuesday and announced plans to close hundreds of locations. Meanwhile, Ralph Lauren Corp announced it will close its flagship Fifth Avenue Polo store.

bankruptcy on Tuesday and announced plans to close hundreds of locations. Meanwhile, Ralph Lauren Corp announced it will close its flagship Fifth Avenue Polo store.

While the unemployment rate fell from 4.7 percent to 4.5 percent in March (the lowest since May of 2007), the retail industry took a hit with the worst two months for job creation since December 2009, according to the Bespoke Investment Group. Almost 30,000 retail workers lost their jobs in March, and more than 60,000 jobs have been eliminated since January.

“Retail is a mess, to say the least” proclaimed Jason Mudrick, hedge fund manager and the founder and current President and CIO of Mudrick Capital Management, on Bloomberg Daybreak: Americas earlier this week. He continued, “this is not a cyclical issue . . . this is a forever trend.”

As stores are closing faster than ever, US shopping malls are left with a glut of space to fill. Last month CEO of Urban Outfitters Richard Hayne sized up the situation by saying, “This created a bubble, and like housing, that bubble has now burst,” he said. “We are seeing the results: doors shuttering and rents retreating. This trend will continue for the foreseeable future and may even accelerate.”

Industry analysts like Oliver Chen at Cowen & Co recommend that retailers “refocus on customers. Management needs to be fixated on speed of delivery, speed of supply chain, and be able to test read and react to new and emerging trends.”

Detailed, expert reporting and analysis of retail POS data enables vendors to do just that. In a blog post on our site earlier this week, technology journalist Scott Koegler wrote about the benefits of using a retail data analysis tool like Accelerated Analytics to improve supply chain responsiveness.

“You can look at trends and predict item performance down to the shelf level in order to plan your recommendations to store buyers,” wrote Koegler. He continued, “Forward thinking suppliers are already taking advantage of the data their customers give them to sell more of their products.”

Sources: CNBC.com, Bloomberg.com, WashingtonPost.com

Get our content delivered to your inbox each week with our weekly update. Sign up at the bottom of our home page.