What is sell-through?

Sell-through is a metric for vendors to use in evaluating item performance which provides a composite measure of sales and inventory. Sell-through rates are typically evaluated daily for fast-moving products or weekly for slower-moving or replenishment-based products. A higher value is better, indicating your sales velocity is good and your inventory is appropriately forecasted. If sell-through is low, this indicates either poor sales or too much inventory.

How do I calculate sell-through?

The most common calculation is:

SELL-THROUGH % = UNITS SOLD / (UNITS ON HAND + UNITS SOLD)

In most cases, sell-through for an item is compared in recent periods (such as current week and last week), as well as in aggregate across several months to a year.

When evaluating sell-through, it can be useful to group together products which have been selling for a similar period of time and/or which are sold into the similar store types. For example, comparing sell-through for a product with 5 weeks of selling activity against a product with 20 weeks of selling activity most likely will not produce a useful comparison. In the same way, comparing sell-through for a product in a group of stores in a highly affluent area is not likely to compare favorably to a group of stores with a low-income level.

What is sell-through data used for?

Most retail buyers have a set sell-through percentage they use to evaluate vendors based on product category or department. It is important for vendors to discuss the sell-through expectations with the buyer in order to align with those objectives.

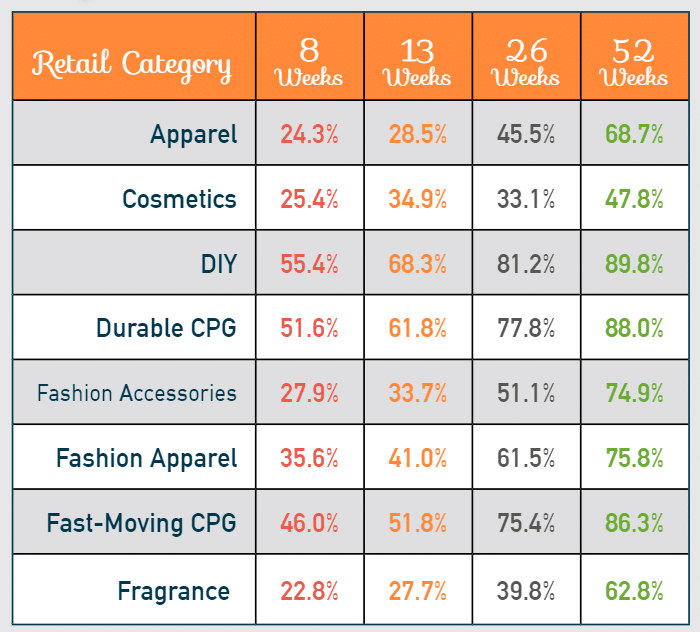

For reference, we’ve compiled sell-through percentage data

that you can use as a benchmark. The infographic includes

the sell-through percentage for eight retail categories

each at 8, 13, 26 and 52 weeks.

![]()

GET STARTED Identify trends, optimize assortments, and track promotions with one-click access to sell-through rates for every one of your SKUs with POS reporting and analytics from Accelerated Analytics!

Find out how we can help you make faster and better-informed decisions with real-time retail data and insightful analytics.