Supply Chain Management (SCM) refers to the complete range of activities needed to plan, control and execute a product’s complete journey, from the purchase of raw materials and production through distribution to the customer receiving their order, in the most efficient and cost-effective manner possible.

If a company wants to compete in international and global markets, they must master their supply chain and networks.

Supply chain management involves the planning and execution of multiple processes that must be implemented to optimize the flow of materials, information and financial capital in the areas that broadly include demand planning, sourcing, production, inventory management and storage, transportation — or logistics — and return for excess or defective products.

Supply chain management also integrates supply and demand management within and across companies. It can include numerous self-organizing networks of businesses that work with one another to provide service and product offerings to customers.

With SCM, companies need the right software and strategies to gain an advantage versus the competition.

Supply chain management is complex, it relies on a number of different partners to run efficiently and effectively. Manufacturers, suppliers and fulfillment, it takes an equal effort from all parties to stay organized and completing tasks. Due to this, effective supply chain management also requires change management, collaboration, risk management, resources and technology to create alignment and communication between all parties.

Supply chain sustainability covers social, legal and environmental issues, as well as sustainable procurement too. All of these are closely related, focused on the pillar of corporate social responsibility, which analyzes a company’s effect on the environment and their social well-being.

Supply Chain Management vs Logistics

Two terms that are often used together but commonly confused is supply chain management and logistics.

While there’s certainly some similarities, logistics is actually a component of supply chain management. Logistics concentrates on moving a product or material in the most efficient way, ensuring it goes to the right place at the right time. It includes activities such as packaging, distribution, warehousing, transportation and delivery.

Now, supply chain management involves a larger range of task, such as procuring the best possible prices on goods, sourcing raw materials, procuring the or coordinating supply chain visibility across your supply chain network of partners.

Benefits Of Supply Chain Management

Supply chain management has a number of different benefits for your company. For starters, it molds efficiencies, helps increase profits, lowers costs and boosts collaboration. SCM is vital to your business as it allows companies to efficiently manage demand, carry the right amount of inventory, deal with disruptions, keep costs to a minimum and meet customer demand in the most effective way possible. These SCM benefits are achieved through the appropriate strategies and software to help manage the growing complexity of today’s supply chains.

The Complexity Of The Supply Chain

The most basic level of a supply chain includes a company, their suppliers and the customers they serve. As an example, the chain could look like:

- Producer Of Raw Materials

- Manufacturer

- Distributor

- Retailer

- The Customer

This is a base supply chain that could work.

When you begin diving deep into a complex supply chain, it can include a lot of different moving parts. A complex supply chain could include many suppliers, even suppliers to suppliers. It can include providers such as third-party logistics (3PL), supply chain software providers, financial companies, even collecting goods for recycling. It can include many organizations, what ever is required to get products to your customers.

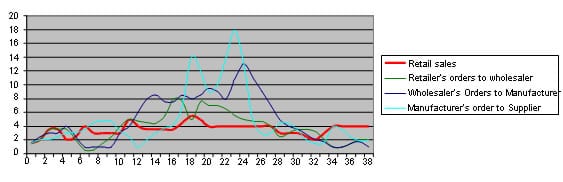

When you have such a complex supply chain, things can go wrong. There’s many things that a company must be aware of. For example, a new product can be released and that may cut demand for the older version of the product. You may have to deal with seasonal holidays, which is often a stressful time for retailers trying to keep product on the shelf. Weather events can also play a role in your supply chain.

Why Supply Chain Software Is Vital

Every company wants a competitive advantage and your supply chain is an area you can optimize. In today’s technological world, supply chain software will play a role in your success. ERP vendors offer a wide range of solutions for you to focus on key areas (or more) of your supply chain. You’ll also find business software vendors that solely focus on SCM.

Supply chain management software consist of modules and tools that are used to execute supply chain transactions, control business processes and manage supplier relationships. Having this software in place is key to management.

There’s a few key solutions you may want to consider.

- Supply Chain Visibility Software – Will help you with spotting and analyzing risk, also allowing you to manage them.

- Supply Chain Planning Software – This will allow you to manage your demand.

- Inventory Management Software – Allows you to track all of your inventory and efficiently optimize inventory levels.

- Supply Chain Execution Software (SCEM) – Helps with your day-to-day manufacturing operations. It considers all possible events and scenarios that could disrupt your supply chain.

- Logistics Management Software – Gives you the ability to track the transport of goods, even globally.

Today, your supply chain plays a bigger role than ever.

The growth of ecommerce and the demand to get products to your customers as quickly as possible has fueled today’s supply chains. While there’s an endless array of options, it also presents challenges for your company as well.

There’s many areas of your SCM where ground can be made, cost can be cut and the input of productivity increased. However, while you have much to gain, there’s also many challenges you’ll face. This is why the right “technology” and “data” is invaluable.

Technology, especially big data, predictive analytics, IT technology, supply chain analytics, robotics and autonomous vehicles, all of these are being used to solve those challenges, reduce risk and avoid disruptions to your supply chain.

Other Terms Related To The Supply Chain

Here’s a few more terms you want to get familiar with that relate to the supply chain.

- Value Chain Definition – A value chain is a tool that analyzes all the activities a business uses to create a service or product.

- End To End – The end-to-end term refers to solutions or products that cover the entire length of a specific process.

- Operations Management – This is the administration of best business practices to create the highest level of efficiency possible within the company.

- Inventory Management – This is the process of ordering, storing, tracking and using a company’s inventory.

- Project Management – Project management involves organizing and planning a company’s resources to move a specific task, process or event toward completion.